That's all for todaypublished at 14:28 GMT 1 February 2024

Nadia Ragozhina

Nadia Ragozhina

Live reporter

We're now wrapping up our coverage.

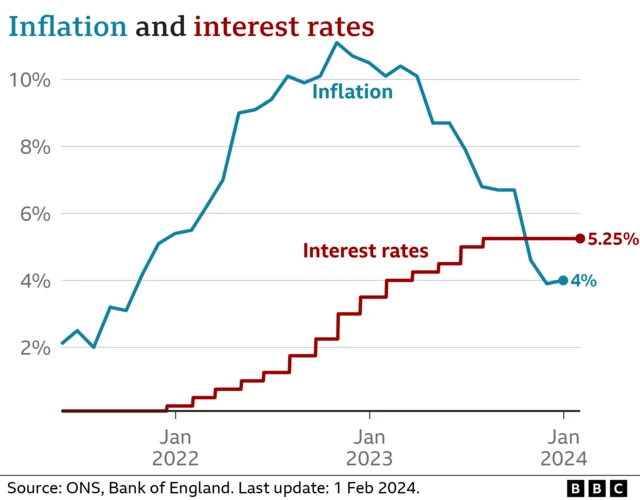

A reminder, the Bank of England announced today that interest rates would remain unchanged at 5.25%

It also released its inflation report in which it said it expected inflation to drop quickly in the next six months before rising again later this year.

If you'd like to read more about today's decision, you can find our main story here.

And if you're curious about how the inflation rate affects you, find that out here.

Today's coverage was edited by me; it was written by Lora Jones, Tara Mewawalla, Johanna Chisholm and Jacqueline Howard.

Thanks for joining us.