'Nothing more, nothing less'published at 12:49 GMT 1 February 2024

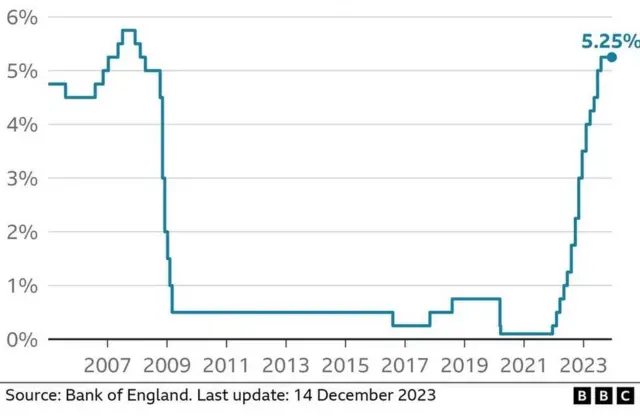

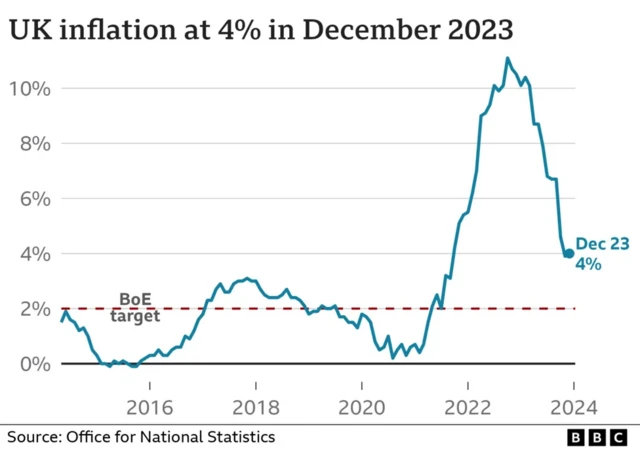

Governor Bailey adds: "If we were to keep [the] bank rate at 5.25% for the next three years, we think it's likely that inflation would eventually fall significantly below target."

He says that the Bank needs to keep "monetary policy sufficiently restrictive for sufficiently long, nothing more, nothing less" to tackle higher prices.

He's referring to interest rates as one of the key tools that the Bank of England has when it comes to bringing inflation down. In theory, by making borrowing more expensive and dissuading people from taking out loans, higher interest rates cool down the economy, easing pressures pushing up prices.

He says the future path for interest rates essentially depends on the numbers.

Key data about the state of the UK economy - wage growth, job vacancies and more - will determine what the Bank of England decides to do.