Unchanged inflation, interest rates and more data tomorrowpublished at 12:35 GMT 14 February 2024

Michael Race

Michael Race

Business reporter

Image source, Getty Images

Image source, Getty ImagesBoE governor Andrew Bailey has said inflation needs to be "under control" before rates are cut

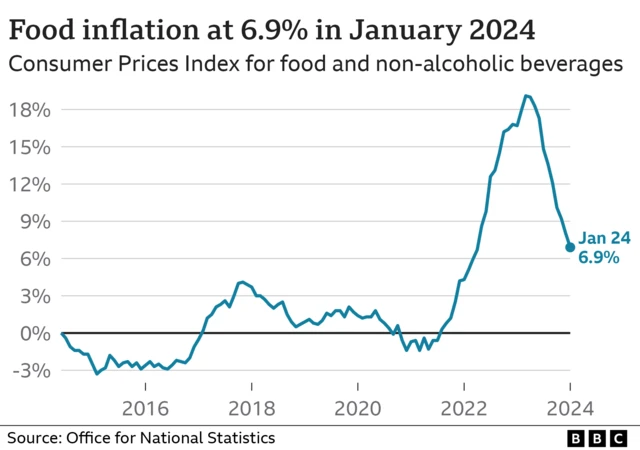

To slow the rate at which prices in supermarkets are rising, the Bank of England tends to increase interest rates - which are currently set at 5.25%, the highest level in 16 years.

The theory behind this is that by making borrowing more expensive, people will have less money to spend. They are also encouraged to save more as saving rates increase.

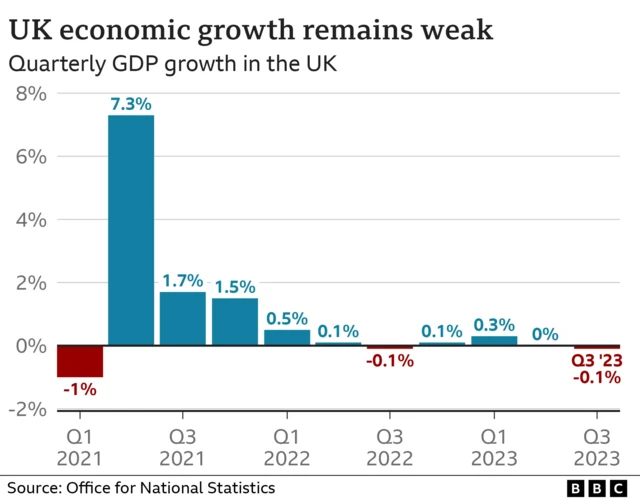

In turn, this is meant to reduce demand for goods and slow the pace of price rises - but it's a balancing act. By increasing borrowing costs, there is a risk of harming the economy as businesses could stop investing and jobs could be cut.

There have been concerns about the UK's weak economic growth for some time, but that doesn't mean interest rates will be cut anytime soon - even with today's unchanged rate of inflation. The Bank has previously said it needs "firm evidence" that inflation is under control before doing so.

The BoE has started discussing rate cuts now, though, and economists are predicting the first cut could come around June of this year.

As we said a little earlier, attention will remain on the economy tomorrow when the latest GDP figures are released. We'll be covering those live too, so join us again on Thursday morning.