Lower inflation doesn't mean prices are fallingpublished at 08:57 GMT 14 February 2024

Michael Race

Michael Race

Business reporter

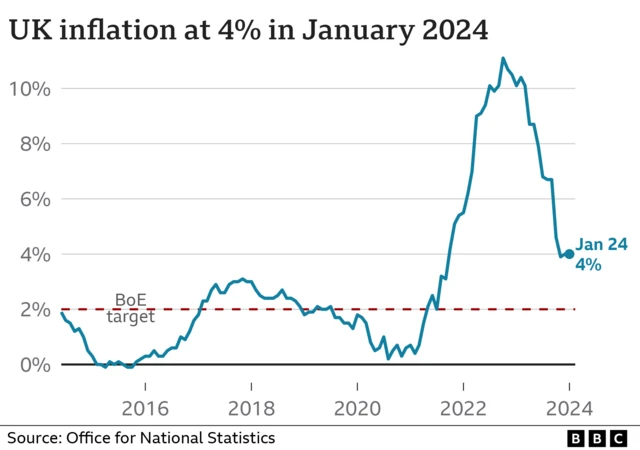

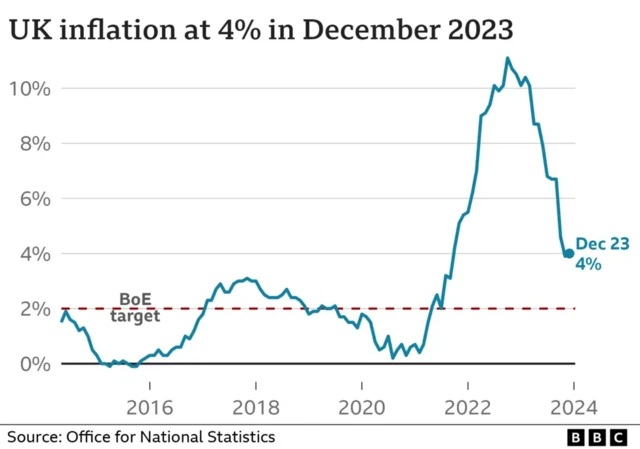

While 4% might not seem like a big number, it's double the Bank of England's inflation target of 2%.

The UK's inflation problems have been caused by three "shocks", according to the Bank of England - Covid, the Ukraine war, and domestic worker shortages.

These three factors led to inflation hitting 11.1% in October 2022, the highest rate in 40 years.

The rate has fallen since then, but lower inflation doesn't mean prices are falling - just that they are rising less quickly.

So while there was no rise in today's figure from last month, things will continue to cost more than they did before.