That's it from uspublished at 15:36 GMT 15 February 2024

Sam Hancock

Sam Hancock

Live reporter

It's been a busy day, with lots of figures to digest, announcements to follow and reaction to keep up with - so thanks for sticking with us. Here's a quick recap of the key points:

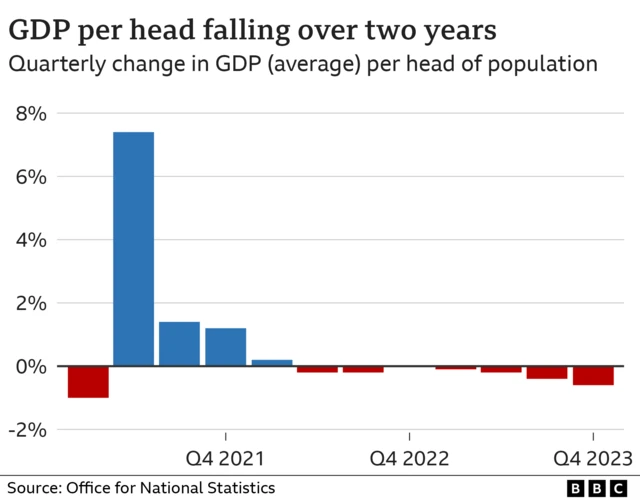

- New figures - published this morning by the Office for National Statistics (ONS) - revealed that the UK fell into recession in the latter part of 2023, following successive drops in Gross Domestic Product (GDP) in the last two quarters

- Despite officially being in a recession, GDP did grow by 0.1% across the whole of 2023

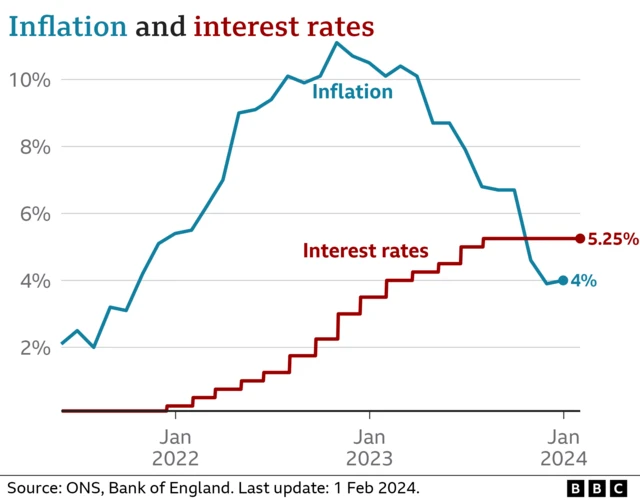

- It's thought the dip might not last long because the UK's jobs market remains strong and wage growth is outpacing inflation

- Chancellor Jeremy Hunt said today's data was "challenging" but insisted there was "light at the end of the tunnel". Labour and other opposition parties dubbed it "Rishi's recession", with shadow chancellor Rachel Reeves saying the country is "trapped in a spiral of economic decline"

- Our cost of living correspondent Kevin Peachey took your questions about what all this means, which you can catch up on in our earlier posts

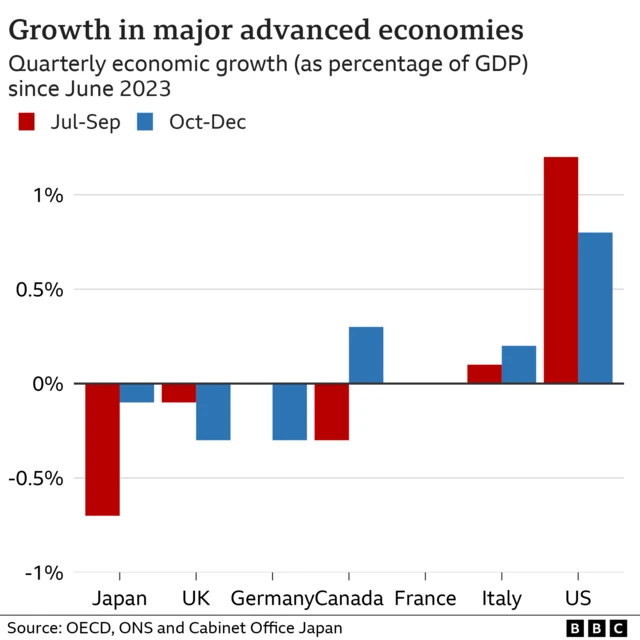

- And a final reminder that the UK isn't alone in experiencing economic difficulty right now - just look at this graphic made by our visual journalism colleagues:

Image source, .

Image source, .Today's coverage was brought to you by Lora Jones, Gem O'Reilly, Alex Smith, Jake Lapham, Craig Hutchison, Gabriela Pomeroy and Emily Atkinson. It was edited by James Harness and me.