All major sectors contracting - but the dip may be short-livedpublished at 07:13 GMT 15 February 2024

Dharshini David

Dharshini David

Chief economics correspondent

Image source, Office for National Statistics

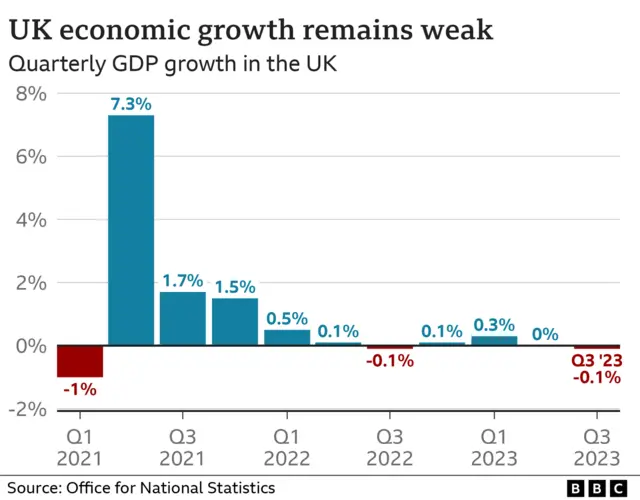

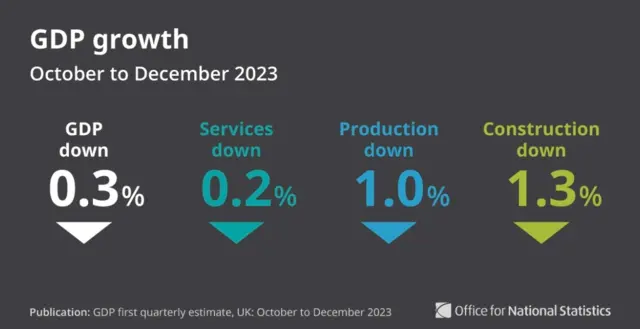

Image source, Office for National StatisticsIt was a combination of higher inflation and interest rates that hit consumers' spending, pushing the UK economy further into reverse.

But with all major sectors contracting, the economy suffered by more than expected at the end of 2023.

That, by most economists' measures, constitutes a recession and could be enough to scupper the government's pledge to grow the economy last year.

However, that dip may be short-lived as the jobs market remains resilient with wage growth typically outpacing inflation - or how fast prices rise, again.

The numbers highlight a thorny issue, though - prosperity has grown at a fraction in recent years of what it did prior to the financial crisis.