Inflation hits highest level in more than a yearpublished at 10:14 BST 21 May

Emily Atkinson

Emily Atkinson

Live editor

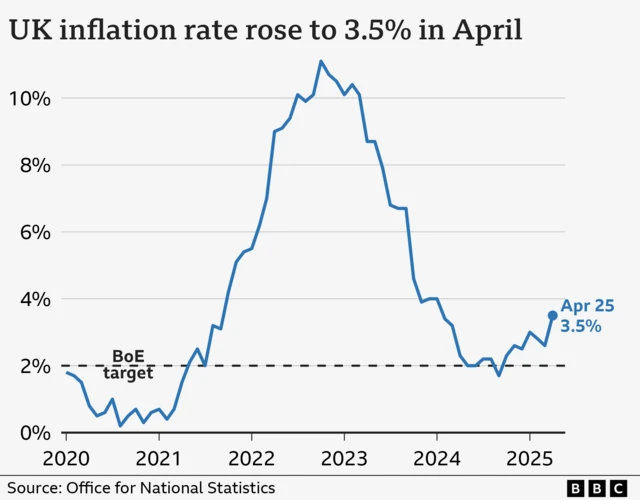

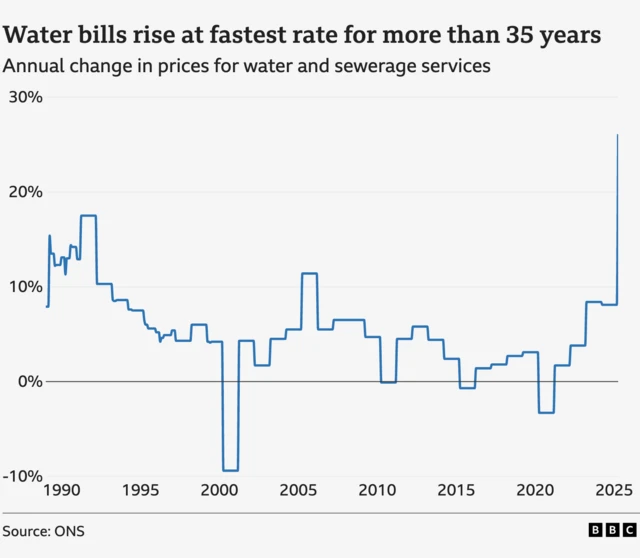

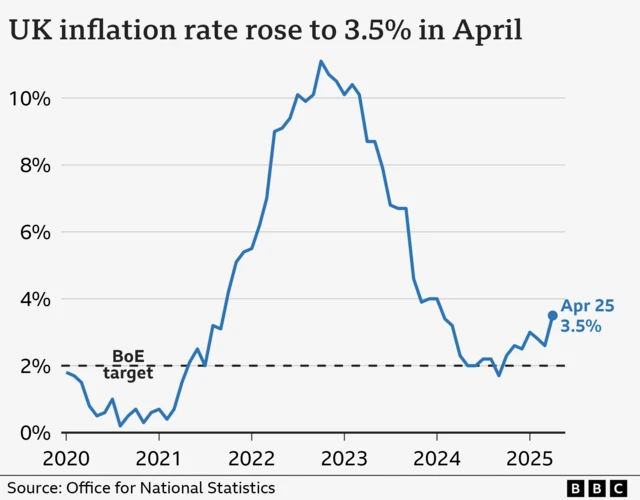

Figures released this morning showed inflation jumped to 3.5% in the year to April, driven largely by increases in household bills, energy costs, airfares and council tax.

The jump was greater than economists had predicted, though it's worth bearing in mind that the Bank of England has previously said it expects inflation to peak at 3.7% between July and September before dropping back to its 2% target.

So, yes, prices are rising - and more quickly than had been expected - but, as our deputy economics editor Dharshini David notes, economists expect many of the effects to be temporary.

Chancellor Rachel Reeves said she was disappointed by the latest numbers. Speaking from a warehouse in London, she acknowledged her policies had "consequences" but insisted that they were necessary to stabilise the economy.

But it's not all doom and gloom. The average prices of petrol and diesel fell by 3p and 3.1p respectively, while clothing and footwear costs eased off by 0.4%.

And it's swings and roundabouts in the supermarkets - senior business and economics reporter Dearbail Jordan looks at what was in and out of last month's inflation trolley.

We're ending our coverage now. This page was edited by me, with reporting from Thomas Mackintosh.

- Read more about today's figures in our main story

- Need a refresh on what inflation is? Check out our explainer