Inflation rate highest for more than a yearpublished at 07:02 BST 21 MayBreaking

The pace of inflation is at its highest since February last year.

The UK inflation rate jumped to 3.5% in the year to April, its highest level since February last year, the Office for National Statistics says

The increase is driven by sharp rises in household bills, and higher food, vehicle duty and airfare costs

The same factors are expected to keep inflation above 3% for some months, but economists expect many of the effects to be temporary, writes deputy economics editor Dharshini David

Chancellor Rachel Reeves says she's "disappointed" by the figures, but will "go further and faster to put more money in people's pockets"

The Tories say families are "paying the price" for Reeves's choices, while the Lib Dems call for "bold action to deliver relief for millions of hard-pressed households"

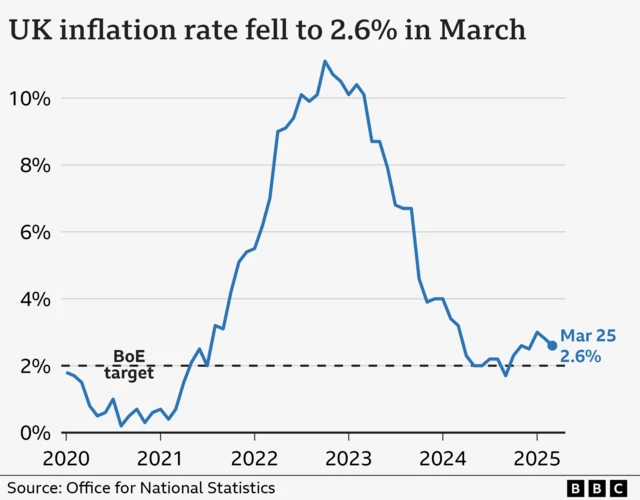

The Bank of England has previously said it expects inflation to peak at 3.7% between July and September 2025 before dropping back to its 2% target

Cost of living still the biggest concern for families, Reeves says

Edited by Emily Atkinson

The pace of inflation is at its highest since February last year.

Inflation jumped to 3.5% in the year to April, up from 2.6% in March, according to the Office for National Statistics.

We'll bring you more on this shortly.

In just one minute, the Office for National Statistics will release its official figures on the rate inflation.

As we've reported through the morning, it's expected to jump to its highest level for over a year due to sharp increases in certain bills and rising food costs.

We'll update you as soon as that figure lands, alongside reaction and quickfire analysis on what this means for you.

Dharshini David

Dharshini David

Deputy economics editor

Image source, PA Media

Image source, PA MediaIt was dubbed awful April: households hit by sharp rises in energy and water bills, and – to a lesser extent – higher food prices.

It’s a combination of those factors that is very likely to have driven inflation above 3% in April. And with sharp rises in gas and food triggering the cost-of-living crisis a few years back, the numbers may prompt some to ask if we are seeing a sustained resurgence in inflation.

But economists expect these effects to be temporary.

Already, for example, wholesale energy and commodity prices are coming down on global markets. Oil prices in particular have fallen as concerns about the world economy intensified after President Trump unveiled his tariff plans.

Those should help curb the rise in inflation in the months ahead.

Yet there are other factors to bear in mind: inflation for services, such as hotel stays and restaurant meals, have dwindled over the last year. But economists are warning that there could be some pressures re-emerging there as bosses deal with tax and wage increases.

Raphael Sheridan

Raphael Sheridan

Economics producer

Ahead of the publication of the new inflation figures, I caught up with James Sanders, a production brewer at Lakedown brewing company.

“Even though inflation has come down, costs of these goods seem to be still be going up,” he told me.

“Some things you can't really save too much on, but some things, yeah, we are having to cut back on,” he says.

James explained that he has had to “make some sacrifices here and there,” such as cancelling subscriptions.

"Personally, I'm finding things just as difficult. It's probably due to the fact that I've got more costs now than I did.”

James added that his family was trying to save more during their weekly shop and “cut down on things that aren't absolutely essential.”

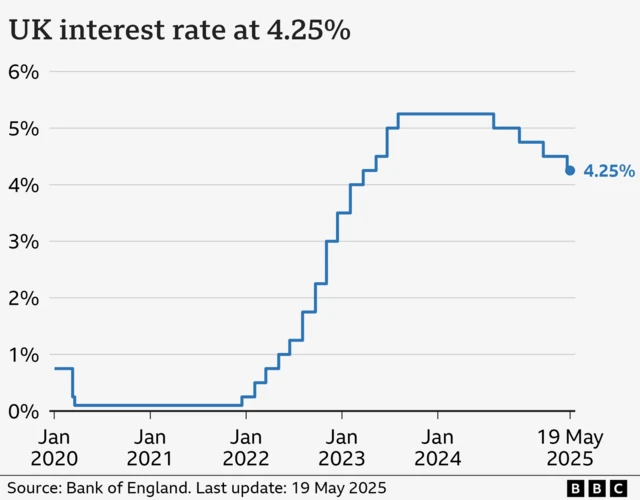

The Bank of England slashed interest rates from 4.5% to 4.25% on 8 May. That was the fourth cut since a year ago, when the rate stood at 5.25% - a 16-year high.

The Bank generally raises interest rates in an effort to tackle rising prices but has now set them on a downward path as inflation has fallen closer to its 2% target.

Higher interest rates can also put the brakes on economic growth because it makes borrowing money more expensive, which can slow demand for goods and services.

With fears that the global tariff war could still hit growth, that might be another reason for the Bank to continue lowering rates.

Dearbail Jordan

Senior Business and Economics Reporter

Just in case you need a reminder of what household costs rose last month (as if we could forget) the BBC pulled together this comprehensive round-up.

More helpfully, readers sent in their questions to us asking what they could do to lessen the pain of the increases and we provided some recommendations.

One glimpse of sunlight for workers is that the National Minimum Wage and the National Living Wage both increased in April.

But, at the risk of raining on the proverbial parade, so did costs for businesses – such as higher National Insurance Contributions.

That means that employers might be choosing to pass those costs on to consumers by bumping up the price of their goods and services.

Image source, Shutterstock

Image source, ShutterstockThe latest inflation figures covering the year to April will be out at 07:00 today. Looking back at the most recent data, prices rose by 2.6% in the year to March.

That was slightly less than economists had predicted, and down from a 2.8% rise the previous month.

According to the Office for National Statistics, the slower rate of increase was partly driven by falling prices at the petrol pumps. But the easing inflation rate is likely to be temporary, with experts pencilling in a 3.3% rise in the year to April.

Inflation is a measure of how quickly prices are rising (or very occasionally falling) for goods and services. It is one of a number of key pieces of data that tell us how the economy is doing, which is why it is reported every month.

A good example of this is if a bottle of milk costs £1 but is £1.05 a year later, then annual milk inflation is 5%.

A series of shocks to the economy over recent years has caused high inflation, the Bank of England says.

First, the Covid pandemic pushed prices up as more people bought goods - but there were problems getting enough of the goods, particularly with importing them from abroad.

Second, the war in Ukraine led to large increases in the price of gas and food.

Then, a big fall in the number of people available to work meant employers began offering higher wages to job applicants, with many businesses increasing their prices to cover these costs.

It is important to understand that things will continue to cost more than they did before, even if the rate of inflation falls.

Good morning and thanks for joining us ahead of the UK’s latest inflation figures being released.

Economists are expecting quite a big jump from 2.6% in the year to March to 3.3% in April.

It’s thought that’ll be down to water, electricity and gas prices, which went up on 1 April.

If that happens, it would bring the rate of price rises further above the Bank of England’s 2% target.

We’ll know for sure at 07:00 BST today. Stay with us for live updates and fresh analysis from our team of business correspondents.