Further reading on what today's inflation rise all meanspublished at 12:42 GMT 19 February

Adam Goldsmith

Adam Goldsmith

Live reporter

We're off to grab an (increasingly pricey) coffee, but before we go, here's some wider reading to walk you through what today's inflation rise might mean for you:

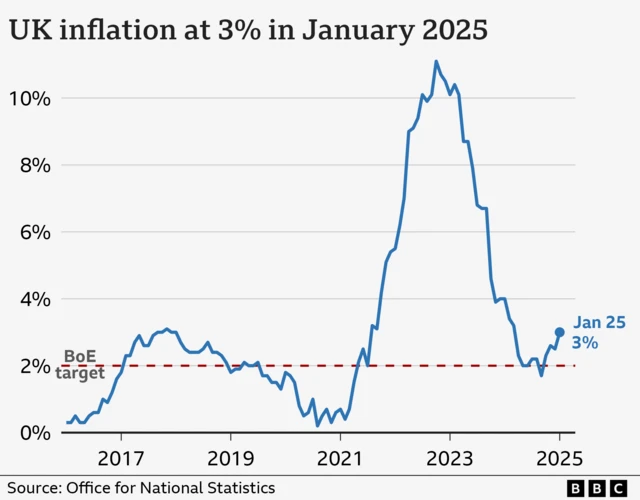

- Our explainer takes you through all the fundamentals on today's inflation increase, including how household staples like meat and eggs all cost more than a year ago

- Some good news here is that UK wages continue to outpace inflation. This might help some keep up with rising prices, but there are warnings employers may cut workforces ahead of higher employment costs arriving in April

- A little earlier on, BBC Scotland's Douglas Fraser took us through what today's figures might mean for housing costs. That's after the ONS reported that house prices increased by 4.6% in the year up to December 2024.

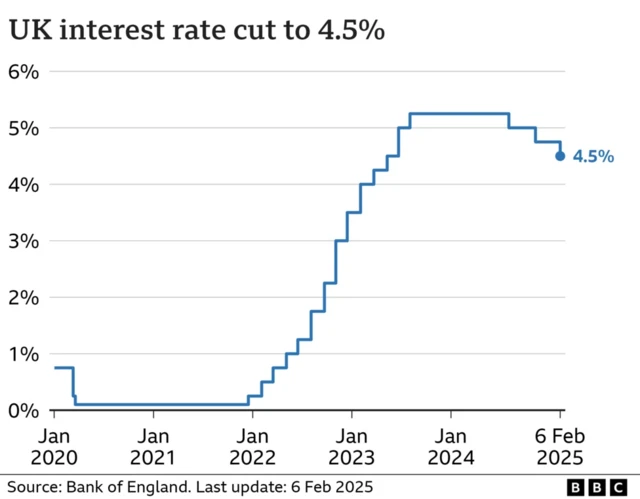

- Coming up: Will the Bank of England choose to cut interest rates, as the government hopes? Business correspondent Theo Leggett says the key question will be whether the rise in inflation proves to be temporary

Thanks for reading.

Image source, Getty Images

Image source, Getty ImagesThis page was edited by Dulcie Lee and Emily Atkinson. The writers were Ruth Comerford, Amy Walker and me.