The Bank of England now faces a question over interest ratespublished at 07:34 GMT 19 February

Theo Leggett

Theo Leggett

International business correspondent

The Bank of England has a problem.

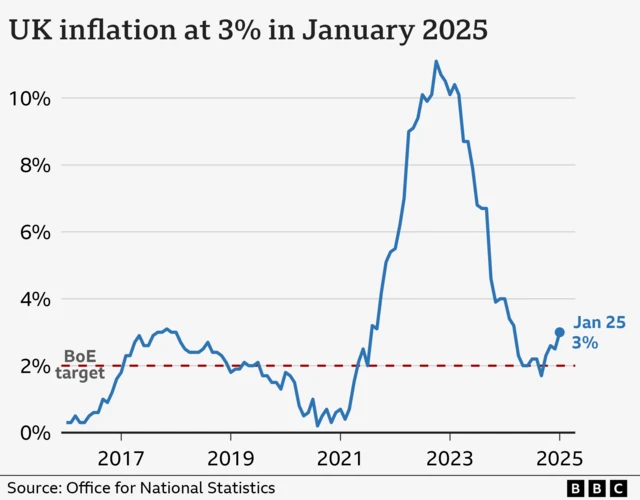

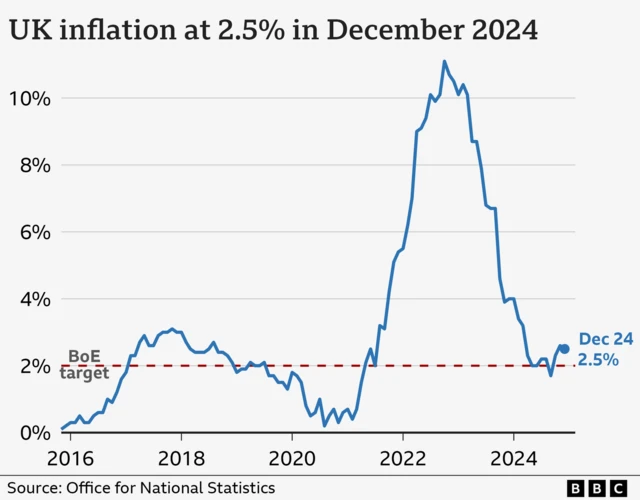

Inflation is ticking upwards, faster than expected. It is now well above the Bank’s own 2% target.

Until now, the Bank has taken a rather sanguine view of this. It fully expects the rate of inflation to continue climbing until the middle of the year, before falling back – a short-lived "hump" of more rapidly rising prices.

At the same time, the economy is weak – it grew by just 0.1% between October and December.

In recent weeks, the Bank’s focus appears to have been on growth. It cut interest rates earlier this month, from 4.75% to 4.5%, and analysts have been expecting further cuts later in the year.

But if inflation picks up greater momentum than expected – and underlying inflationary pressures mount – the Bank may feel priorities have to change. That would mean keeping rates higher for longer.