A flurry of Trump comments, decisions and orders flood the US on Mondaypublished at 01:55 GMT 11 February

Phil McCausland

Phil McCausland

Reporting from New York

Watch: Trump says 'let hell break out' if Hamas hostages not released by Saturday

The US was hit with a wave of breaking news over the past few hours after a series of comments, decisions and orders were made and issued by President Donald Trump.

Here's a quick recap of what has occurred in US politics today:

- Trump issued a 25% steel and aluminum tariff on all countries, raising fears of a potential trade war and increased consumer costs.

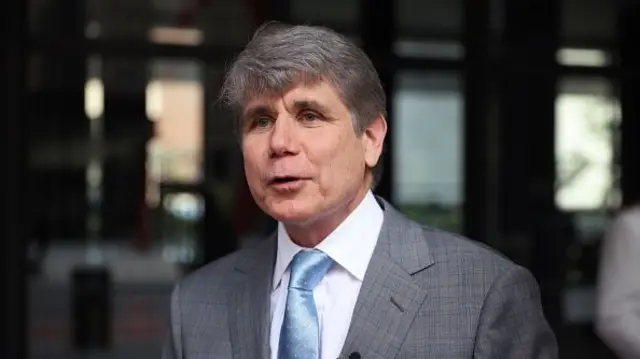

- The president pardoned former Illinois governor Rod Blagojevich years after the Democrat was found guilty of political corruption charges

- Acting Deputy Attorney General Emil Bove, a Trump appointee, told prosecutors to drop corruption charges against New York City Mayor Eric Adams - a Democrat who has met with Trump recently

- Trump gave his own deadline for the release of all Israeli hostages and threatened to end the fragile ceasefire in Gaza if Hamas didn't give in to his demands. However he said he had not yet talked to Israel about his idea for a deadline

- Another executive order issued by Trump promoted the use of plastic drinking straws, rather than paper ones, rejecting sustainability efforts to reduce their use

- A federal judge in Massachusetts blocked the Trump administration's attempt to cut funding to the National Institutes of Health, which critics alleged risked necessary medical research and health centres

- Earlier, in what some experts considered a rebuke of the US Constitution, Vice-President JD Vance claimed that US judges do not have the authority to stymie the Trump administration's executive power

These are just a few of the many news lines to come of out of the United States tonight. You can find more of our reporting on Trump's tariff decision here. You can read about Blagojevich's pardon here, and click here to read about Vance's comments that rattled some US Consitution experts.

We also have the latest on the status of Adams' case here, and keep up with the latest Gaza developmements here.

We're now pausing our live coverage. Thanks for joining us.