Interest rates remain at 4.5% - so what happens next?published at 14:53 GMT 20 March

Owen Amos

Owen Amos

Live editor

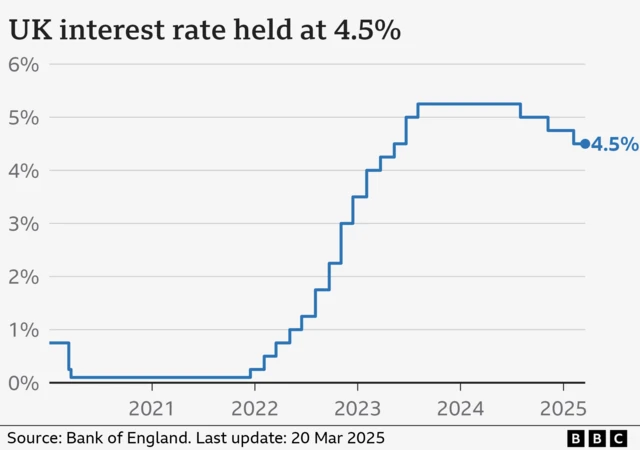

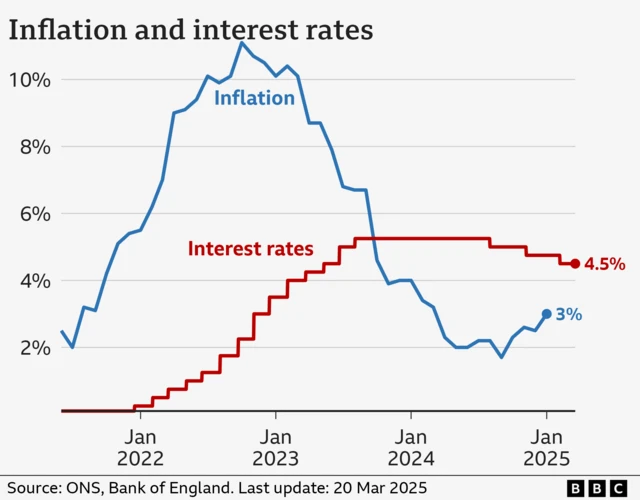

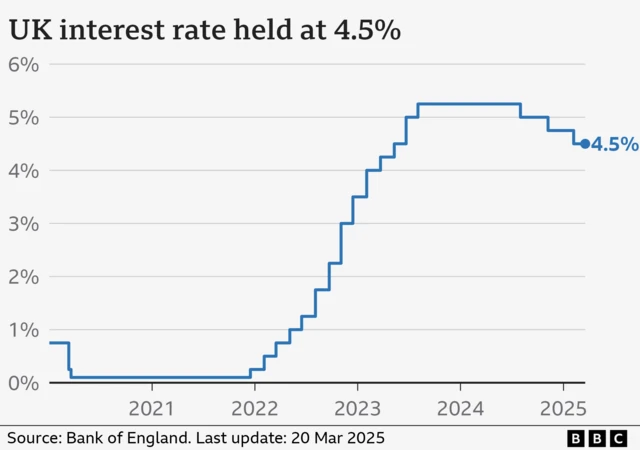

At 12:00 GMT, we got the decision we were expecting - the Bank of England held interest rates at 4.5%.

The nine-person Monetary Policy Committee, which sets the rate, voted 8-1 in favour of holding - with one member voting to cut.

That decisive vote is being seen by some as a sign that rates will remain at 4.5% for longer than expected. But - as with all economic forecasts - no-one can be certain.

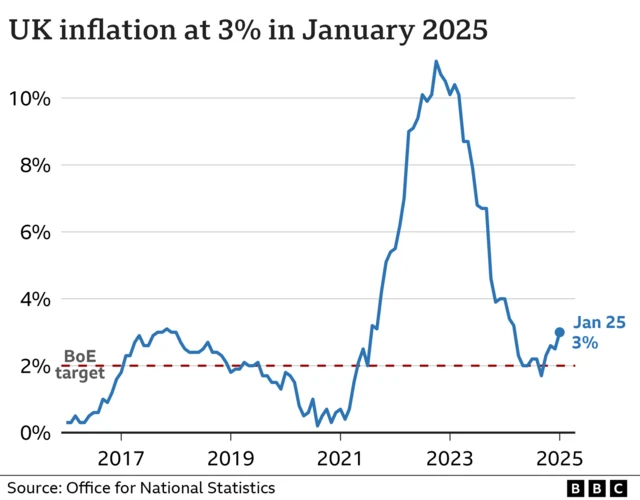

The MPC said "global trade policy uncertainty has intensified" in recent weeks, citing US tariffs and other countries' responses.

Yet while Bank of England Governor Andrew Bailey acknowledged that uncertainty, he also said: "We still think that interest rates are on a gradually declining path."

As part of Your Voice, Your BBC News, our cost of living correspondent Kevin Peachey has answered your questions - see what he said about mortgages here, and student loans here.

Our live coverage is closing now - our wrap-up story is here. Thanks for reading.