What will today's decision mean for savers?published at 11:35 GMT 20 March

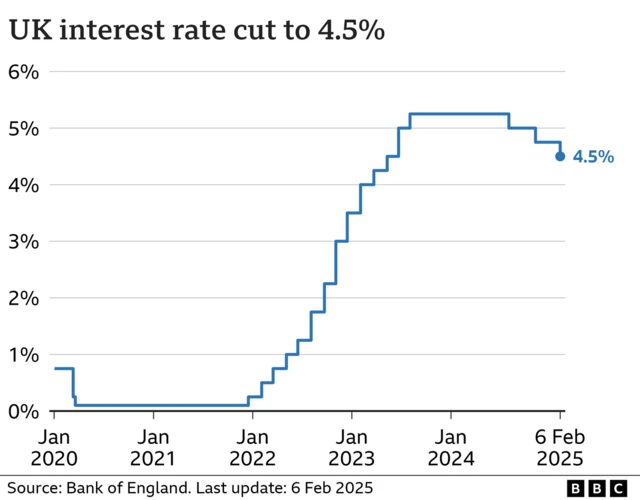

Any cut in interest rates would be good for borrowers, but bad for savers.

Many people are both, of course, but savings can sometimes be overlooked on a day like today.

Banks and building societies would be likely to change the rates on variable savings accounts, if there is a base rate move. The current average for an easy access account is 3%.

Overall, the returns on savings have been relatively high, analysts say, but it is those who shop around or who lock-in those savings for a set period of time who’ve been getting the best deals.

A higher base rate is generally good news for savers - although many people are both savers and borrowers