Trump passes on pausing tariffs as global turmoil deepenspublished at 22:53 BST 7 April

Image source, Getty Images

Image source, Getty ImagesUS President Donald Trump has said he's not considering a pause on new tariffs, saying he wants to allow time for negotiations with other countries.

Asked specifically in the Oval Office about a potential break - reports which were refuted earlier by the White House, who called it "fake news" - Trump was direct: "We're not looking at that."

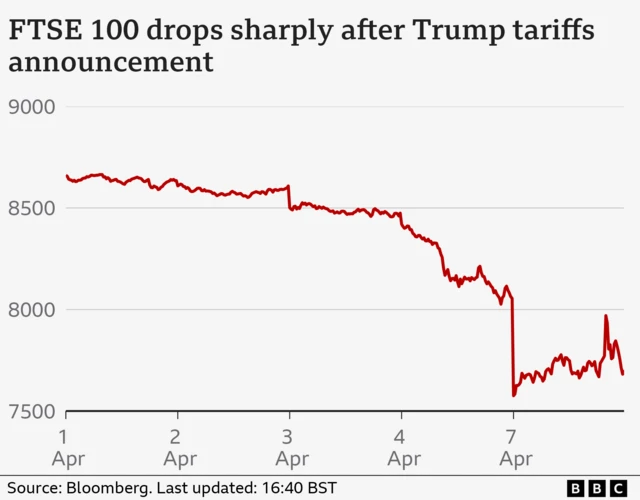

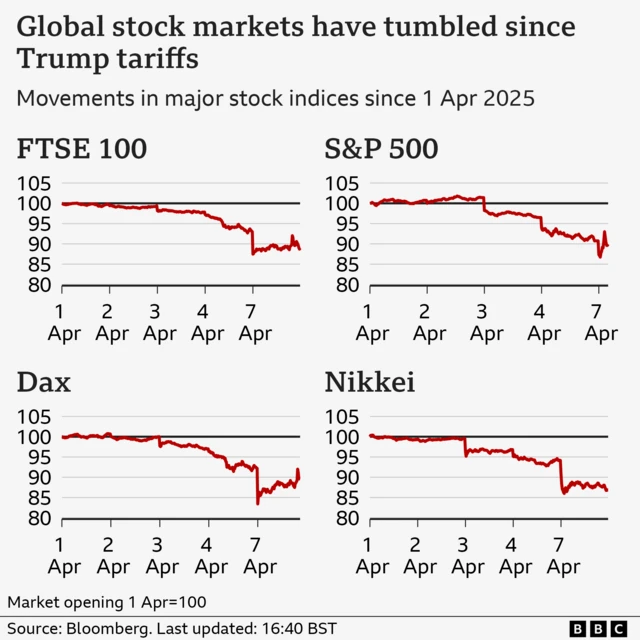

The closing figures might not have looked dramatic over on Wall Street, but there were big swings throughout the day - a sign that investors are still feeling very nervous about how White House policies might play out, our business reporter Natalie Sherman writes.

European and Asian markets both slumped for another consecutive trading day, as US tariffs continue to send shockwaves through global supply chains.

The US president also reiterated his threat of additional 50% tariffs on Chinese goods if Beijing did not walk back from its 34% counter tariffs - that must be done, he says, by midday tomorrow.

The White House later told AFP news agency that with the incoming 34% rate and the additional 50% threat, the total extra tariffs on China this year could rise to 104% (the exact rate will be dependent on the product).

In response (to the response), China's US embassy spokesman tells CBS News, the BBC's US partner, that "pressuring or threatening China is not a right way to engage".

Our live coverage is wrapping up, but you can stay up to date by reading our news stories: