How tariffs impacted UK and European markets this weekpublished at 18:09 BST 11 April

Tommy Lumby

Business data journalist

Global trade tariffs continued to rock UK and European markets this week, although losses were smaller than the first week after Trump’s announcements.

The FTSE 100, which tracks the UK’s largest listed companies, finished down 1.1% over the week on Friday, compared with 7.0% the previous week.

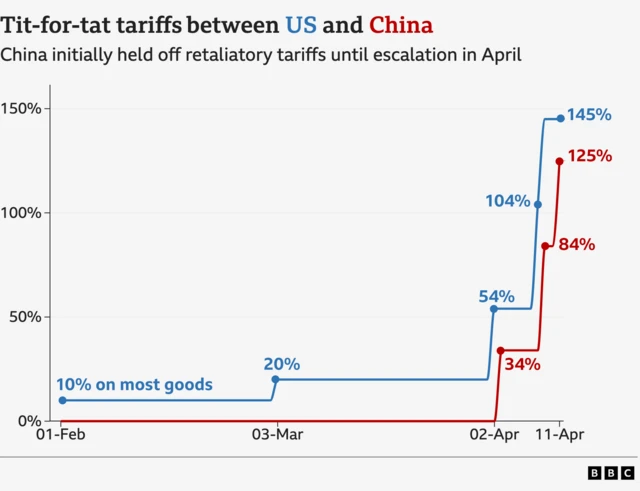

The share index had closed well down on Monday after Trump’s 10% baseline tariffs came into effect over the weekend.

It partially recovered later in the week, helped by a surge on Thursday after Trump paused the heftier tariffs brought in on the countries he deemed “the worst offenders” against the US.

It was a similar story for some of the major European stock markets. Germany’s Dax closed 1.3% down this week, a more modest fall than the 8.1% drop last week.

France’s Cac 40 fell 2.3%, less than the 8.1% fall last week.