Why is gold deemed a safe-haven during economic troubles?published at 14:02 BST 11 April

Michael Race

Michael Race

Senior economics and business reporter

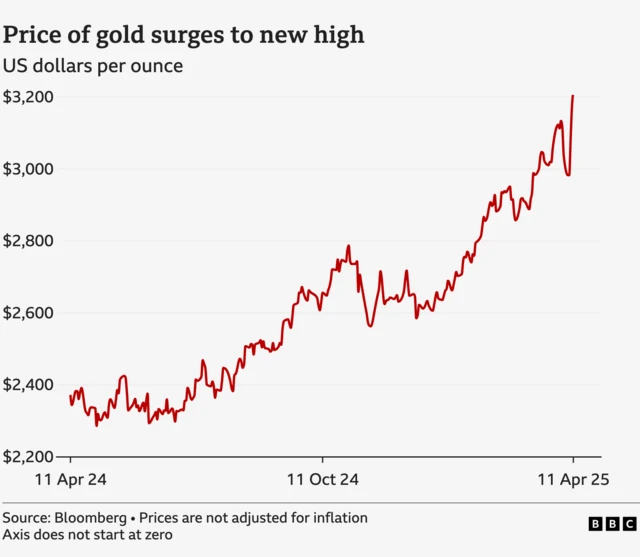

The price of gold has hit an all-time high again as investors have flocked to buy up the precious metal due to economic uncertainty and the turmoil on global financial markets this week.

Bullion prices rose to more than $3,200 (£2,439) an ounce on Friday as the trade war between the US and China intensified.

But why is gold deemed such a safe-haven for people to put their money into?

Gold's safe-haven status is a result of its intrinsic value and historical significance, according to the maker of UK coins, the Royal Mint.

"Investors turn to gold for stability, a timeless resource they can rely on," it says. "Unlike paper currencies, which can lose value due to inflation or economic turmoil, gold’s intrinsic worth endures," it says.

Gold has been valuable to mankind for centuries. It's a scarce metal, but not completely rare. It has a relatively low melting point and so can easily be made into coins or jewellery.

While silver tarnishes over time, gold doesn't.

As Tony Hadley sang the Spandau Ballet classic: "You're indestructible."

He was "always believing", in gold - investors continue to do so as well.