No surprises as interest rates heldpublished at 13:30 BST 19 June

Neha Gohil

Neha Gohil

Live reporter

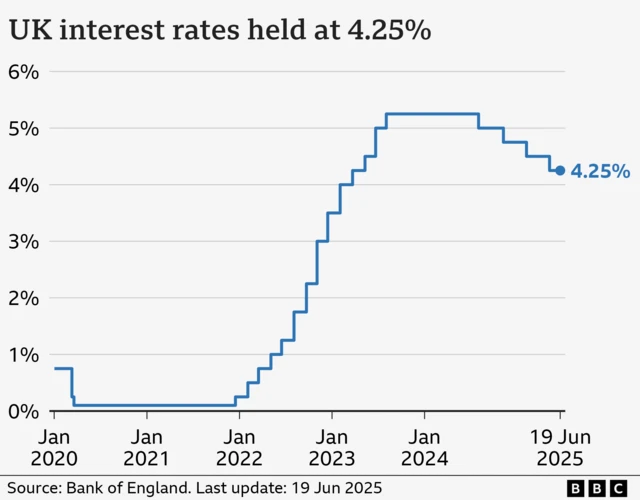

The Bank of England has held interest rates at 4.25%, meeting the expectations held by markets and experts this morning.

Following the announcement, governor Andrew Bailey hinted at cutting rates in the future - which some believe could happen as soon as August.

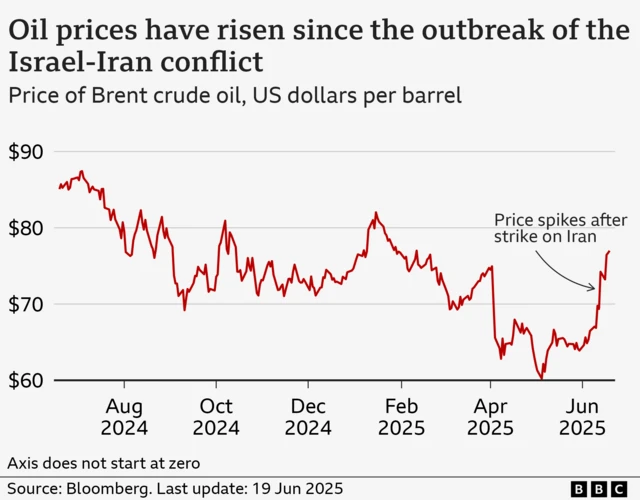

Bailey said rates remain "on a gradual downward path", but warned "the world is highly unpredictable" and expressed concerns over the labour market and wages. He also said the Bank is monitoring the escalating tensions in the Middle East, particularly its impact on rising oil prices and therefore on inflation - the rate of rising prices overall.

As a reminder: Interest rates tell you how much it costs to borrow money, or the reward for saving it

Interest rates have been on a slow decline since it reached a peak of 5.25% in August 2023.

A leading UK business lobbying group said they believed the pause is a "pit stop on the way down". But other experts have cautioned the decision represents a huge blow to those with high mortgage costs.

Our business reporter noted in recent years the UK has had one of the highest interest rates in the G7 but, broadly speaking, central banks in have all been moving in a downward direction.

Our cost of living correspondent reports that, although a hold in interest rates suggests very little drama for household finances, there is still plenty to consider - including its impact on mortgages.

We are ending our live coverage now, but you can stay across this story on here: