Recap: The current situation with inflationpublished at 11:30 BST 19 June

Tommy Lumby

BBC business data journalist

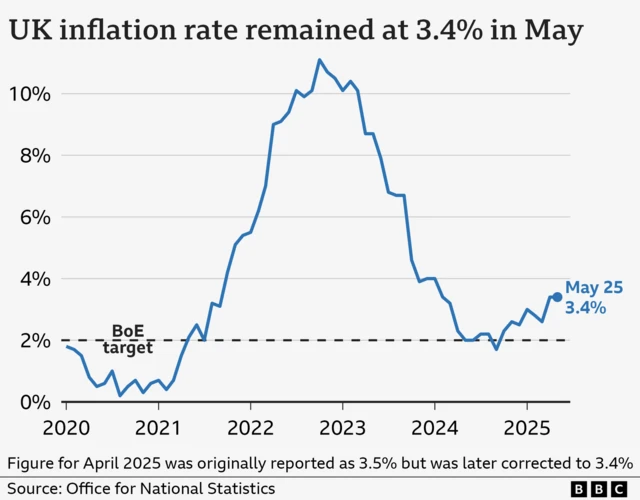

Prices across the UK rose at an average rate of 3.4% in the year to May, meaning inflation remained at its highest level for more than a year.

April’s figure was initially published as 3.5% but was later corrected to 3.4% after an error with the data was discovered.

The latest figure was a touch higher than some market analysts had predicted, and as this chart shows, still well above the Bank of England’s 2% target.

This slightly elevated level of inflation isn’t necessarily an immediate cause for concern. Official forecasts expect the rate to rise this year before falling back towards the Bank’s target.

But these numbers don’t capture the recent rise in oil prices caused by the worsening conflict in the Middle East.