Inflation reaches highest level since January 2024published at 10:15 BST 20 August

Rachel Clun

Business reporter

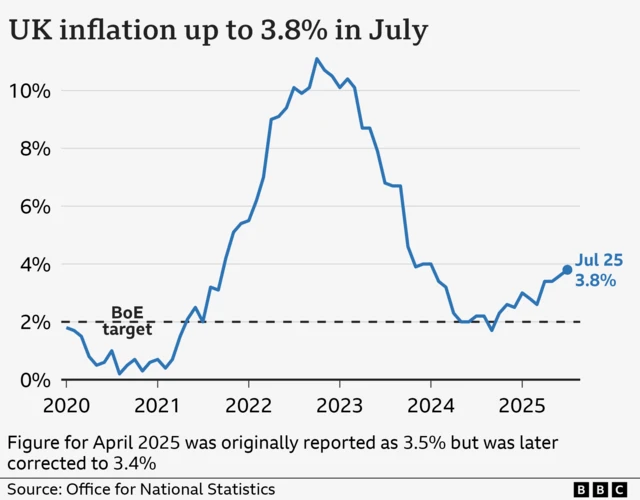

Inflation rose to 3.8% in the year to July, the highest since January 2024, the latest figures from the Office for National Statistics (ONS) show.

While the inflation figure was slightly higher than experts expected, the Bank of England predicts it will reach a peak of 4% in September before beginning to fall back towards the Bank’s 2% target.

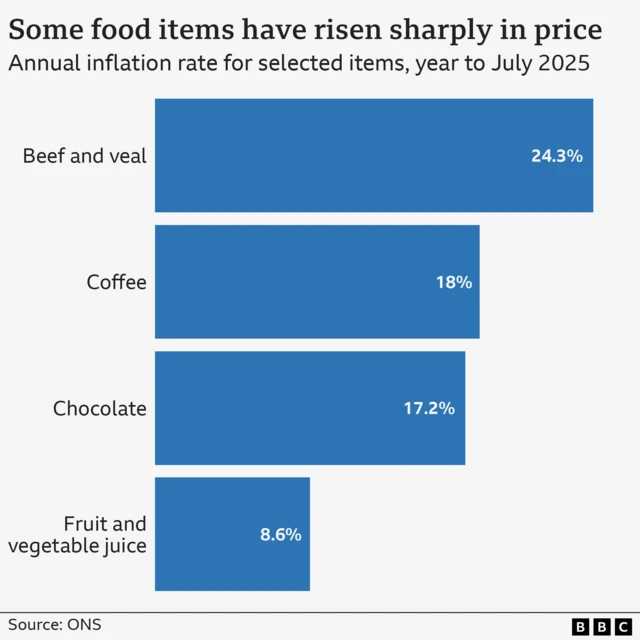

This increase was mainly driven by soaring air fares - which jumped by 30.2% - driven by higher school holiday prices - here's why. Meanwhile, food price inflation rose to 4.9% driven by higher prices for goods including beef, instant coffee and orange juice.

In the past five years to July, the price of food and non-alcoholic drinks rose by around 37%.

BBC's Colletta Smith says households on lower incomes will be hit harder, and deputy economics editor Dharshini David says food price rises underpin concerns it could take a while for inflation to fall to 2%.

Chancellor Rachel Reeves said there was “more to do to ease the cost of living”, while shadow chancellor Mel Stride said the data was “deeply worrying for families”.

In Manchester, a chocolate shop owner tells the BBC that businesses are having to come up with "innovative" solutions to cut costs, while a farmer in Cheshire warns a poor harvest spells bad news for the price of eggs and meat.

We're now ending our live coverage. Before we go, here’s a reminder of what you need to know from this morning. And remember, we'll have more inflation data from the ONS next month.

- Read more about today’s figures in our main story

- Need an inflation refresher? Check out our explainer