Increases in air fares drove inflationpublished at 07:06 BST 20 AugustBreaking

Rachel Clun

Business reporter

Image source, Getty Images

Image source, Getty ImagesOffice for National Statistics (ONS) chief economist Grant Fitzner said the main driver of inflation was higher air fares, which experienced the largest July increase since the ONS began collecting that data on a monthly basis in 2001.

“This increase was likely due to the timing of this year’s school holidays,” he said.

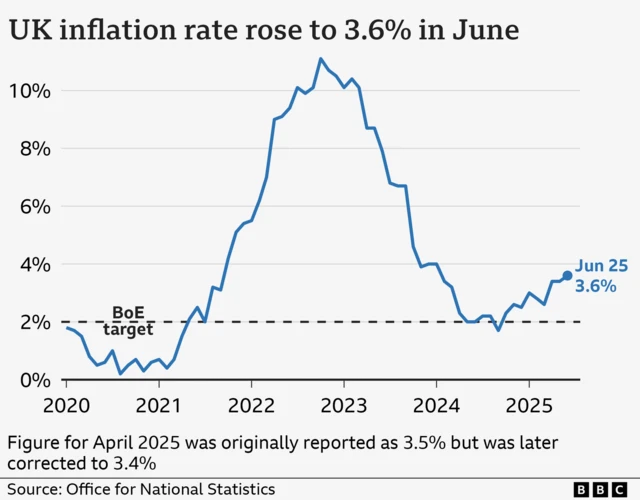

It’s the highest rate of inflation since January 2024, when annual inflation was 4%.