This is what you might call a kitchen-sink Budgetpublished at 16:00 GMT 30 October 2024

Faisal Islam

Faisal Islam

Economics editor

A £70bn a year rise in spending - so 2% of GDP - raising the size of the state closer to European levels.

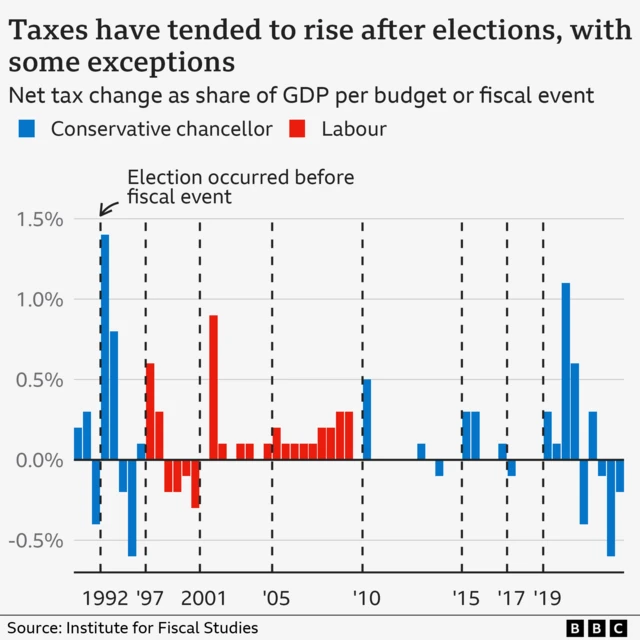

It is half funded by one of the biggest tax raising budgets outside of a recession, and half from a significant increase in borrowing.

The National Insurance rise at £25 billion a year for employers, netted off by a £5bn cost to public sector employers. It raises £20bn a year in total, one of the biggest single tax-raising measures in history.

The chancellor says this is driven by a problem she could only have seen since coming to power. And so it is also a Budget of blame. The chancellor looked like she was laying a charge sheet against former Treasury ministers for crimes against spending forecasts.

She points to the OBR verdict that its forecast at the last Budget would have been “materially different” had the Conservative-run Treasury been clearer about spending.

The new government claims this was a cover-up of the need for spending rises. It will be Labour’s version of Liam Byrne’s infamous “there is no money” letter.

This Budget will “wipe the slate clean on the fiscal fiction” of the previous government, sources suggest to me. The chancellor listed what she said was irrefutable evidence that the plans were never going to be delivered.

What does this all mean?

Public services will get an immediate injection. A line can be drawn under the years of austerity, at least until a longer term spending review.

The revenue raised by tax rises is directed at kitchen-sinking health spending in order to deal with record backlogs, that are now having an impact on the labour market and therefore growth.