Government to crack down on fraudpublished at 12:59 GMT 30 October 2024

Image source, PA Media

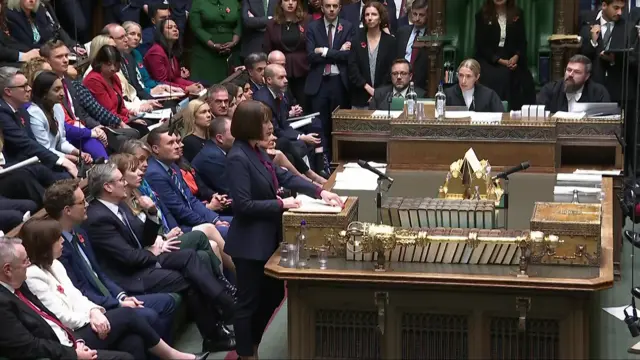

Image source, PA MediaJust before the minimum wage increase was announced, Reeves said that the government would crack down on fraud.

She adds that the government will publish a “Get Britain Working” white paper designed to get those who are unemployed back to work and reduce the strain on the benefits system.

There will be a new crackdown on tax avoidance, Reeves adds.