Focus turns to Bank's next interest rate decision as inflation holds at 3.8%published at 10:07 BST

Lucy Hooker

Business reporter

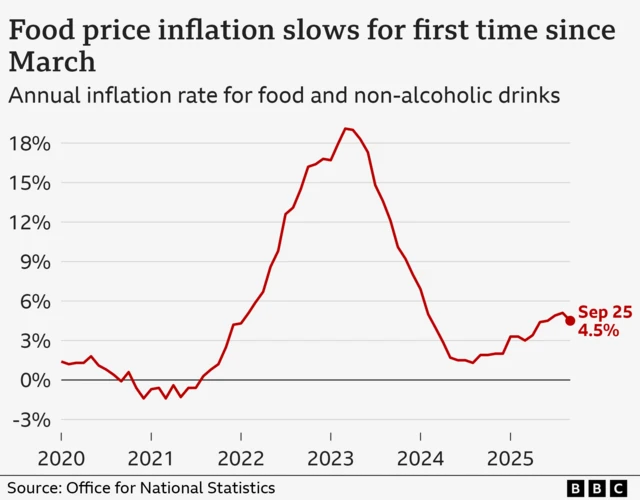

For a lot of people, the main takeaway from today's slightly lower-than-expected inflation rate of 3.8% is a sense of relief that their weekly shop isn't getting more expensive.

But as my colleagues have pointed out, for economists the big question is what does it mean for interest rates.

Inflation is of course still well above the Bank of England's 2% target, but signs of it easing should help pave the way for another cut in interest rates as early as at their next meeting on 6 November.

And above all, as Faisal noted earlier, it does take the pressure off the chancellor, just a fraction, as she sweats over final plans for her Budget in five weeks' time.

We're now ending our live coverage of today's inflation figures, but you can read more in our full report.