Food and non-alcoholic drinks prices fall for first time since May last yearpublished at 07:18 BST 22 October

Image source, Getty Images

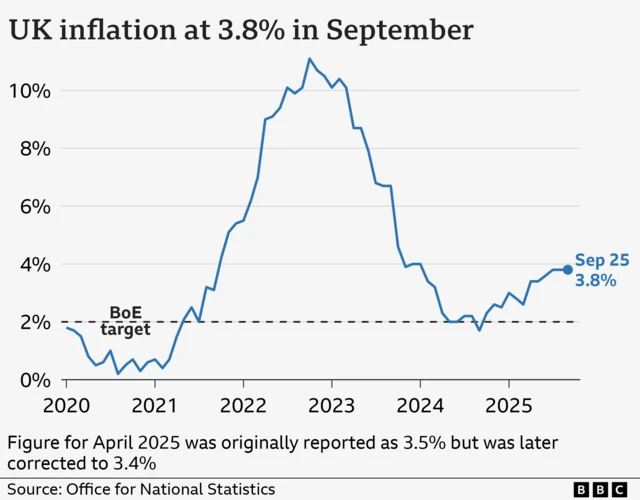

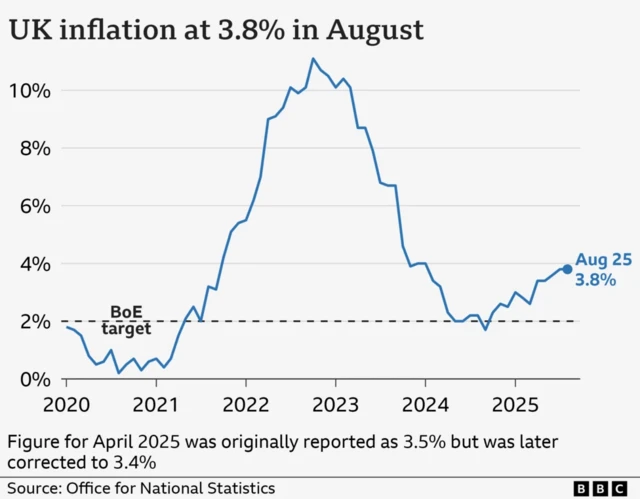

Image source, Getty ImagesWe've got some explanation for the surprise holding of inflation at 3.8% from the ONS chief economist Grant Fitzner.

He says there was a variety of price movements which contributed to the continuing price rises, with petrol prices and airfares driving costs up, whereas cultural purchases - such as live events - offset that with lower prices.

He also says that food and non-alcoholic prices fell for the first time since May last year.