Thanks for joining our live coveragepublished at 14:06 BST 1 August 2024

Barbara Tasch

Barbara Tasch

Live editor

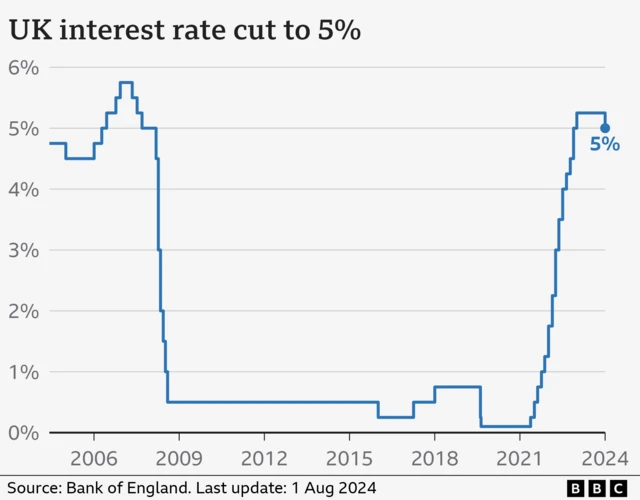

We are coming to the end of our coverage of the Bank of England's announcement to cut interest rates to 5% - the first cut to rates since March 2020.

As we have been reporting, despite the Bank's move, its governor has cautioned against cutting interest rates "too quickly or by too much".

The Bank is also forecasting that inflation will increase to about 2.75% later this year, before returning to its 2% target next year.

You can read more from economics editor Faisal Islam here and business reporter Dearbail Jordan here.

And to find out more about when mortgage rates might come down read on here.