How do interest rates impact inflation?published at 11:37 BST 1 August 2024

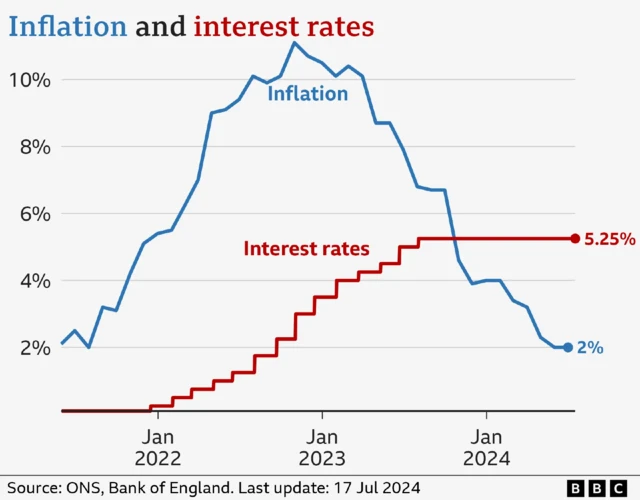

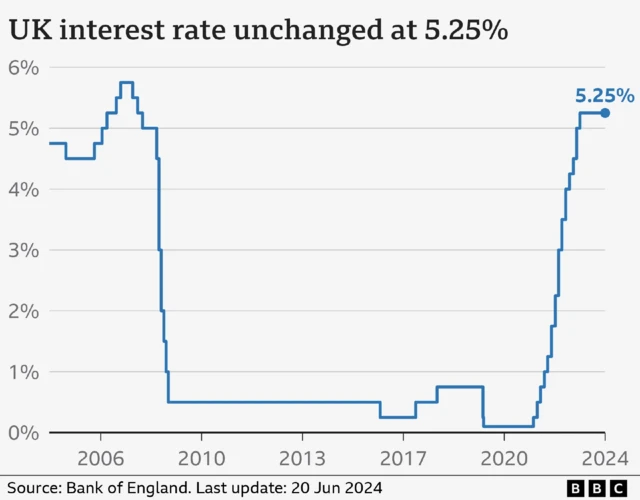

The Bank of England has a target to keep inflation at its current rate of 2%. The traditional response to rising inflation is to put up interest rates.

This theory is that by making borrowing more expensive, people have less money to spend and in turn buy fewer things, reducing the demand for goods and leading to price rises to slow.

But it’s a balancing act. High borrowing costs can also lead to businesses borrowing less, making them less likely to invest and create jobs.

This can impact economic growth - which has been sluggish in the UK for some time.