This budget is the 'cost of chaos' - Lib Dem MPpublished at 13:36 GMT 17 November 2022

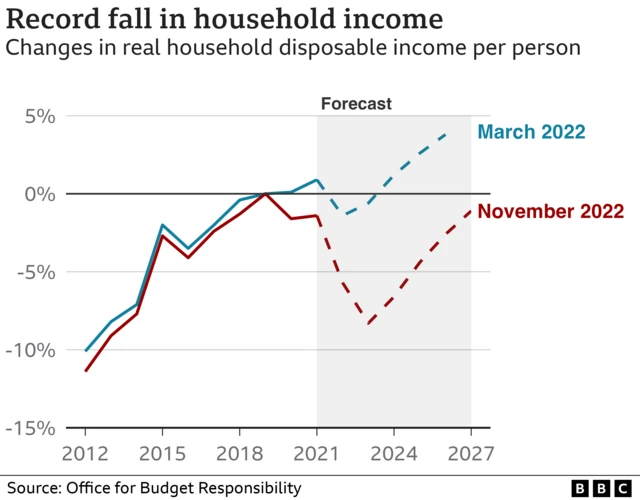

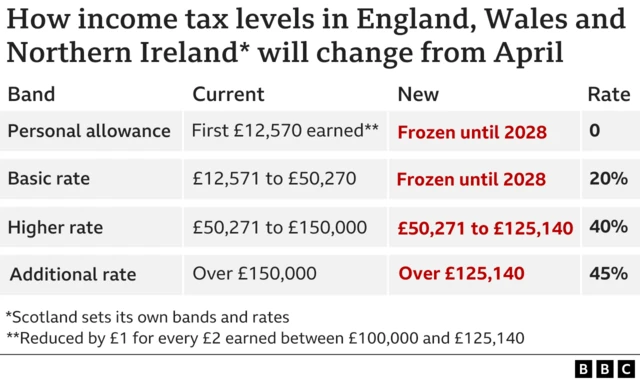

"This Conservative government has plunged the economy into chaos, and now they're asking ordinary families to pay for their incompetence."

She asks: "Who voted for this?"

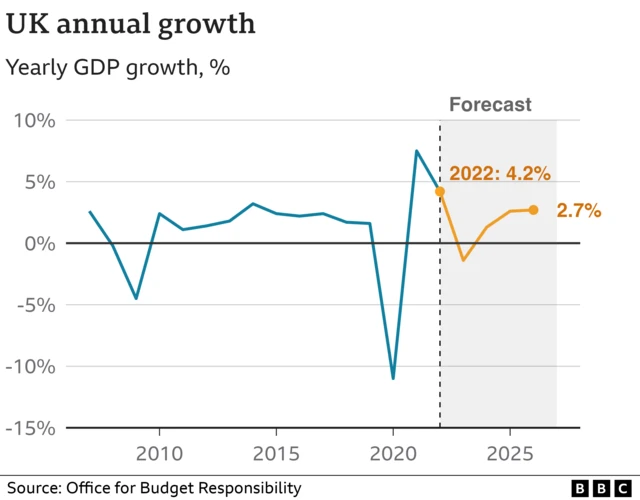

Chancellor Jeremy Hunt says that the OBR says inflation will be lower, bringing down pressure on mortgages. He says the UK voted for Conservatives to make "tough economic decisions".