Thanks for joining uspublished at 11:02 GMT 20 December 2023

We're now wrapping up our coverage, but before you go let's take a look at some of today's main headlines.

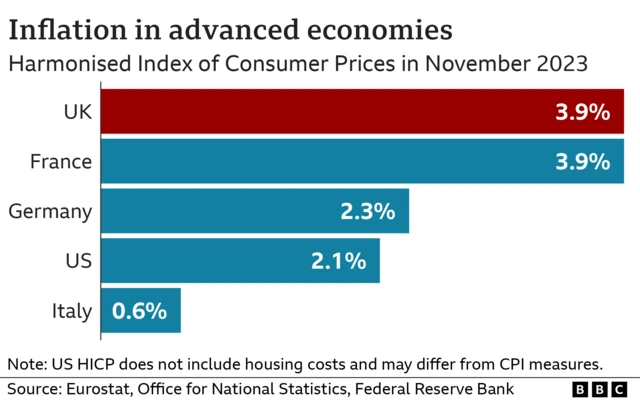

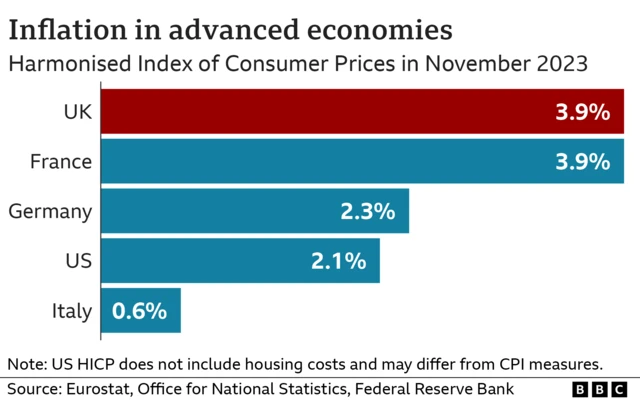

- The Office for National Statistics (ONS) announced that the latest inflation figure for the UK is 3.9%, making it the lowest annual rate of price rises in more than two years

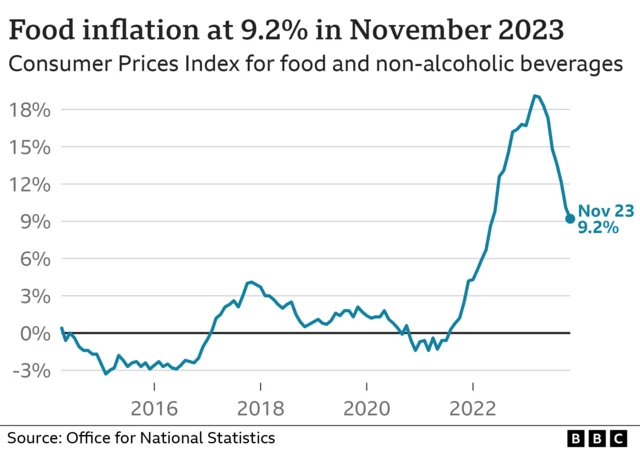

- Staples such as pasta, milk and butter were identified as some of the main items that saw slowing price rises

- Inflation is now well below its peak in 2022, but it is still almost double the Bank of England's 2% target

- Chancellor Jeremy Hunt said the UK is "back on the path to healthy sustainable growth"

- Shadow chancellor Rachel Reeves welcomed the drop but said the Tory government's "economic failure" have left working people "still worse off"

If you want to read more about the biggest factors behind the inflation drop - from second-hand car sales to the bread and cakes - go here.

To find out your personal inflation rate, you can use our calculator (developed with the Office for National Statistics) here.

And with Christmas just a few days away, find out more about how much you're likely to spend on food bills for your festive dinner here.

Today's coverage was edited by Nadia Ragozhina and Nathan Williams. Our writers were Ece Goksedef, Derbail Jordan and Malu Cursino.