What does it all add up to?published at 18:08 BST 8 July 2015

The effects of all these Budget changes

Chris Cook

Chris Cook

Newsnight Policy Editor

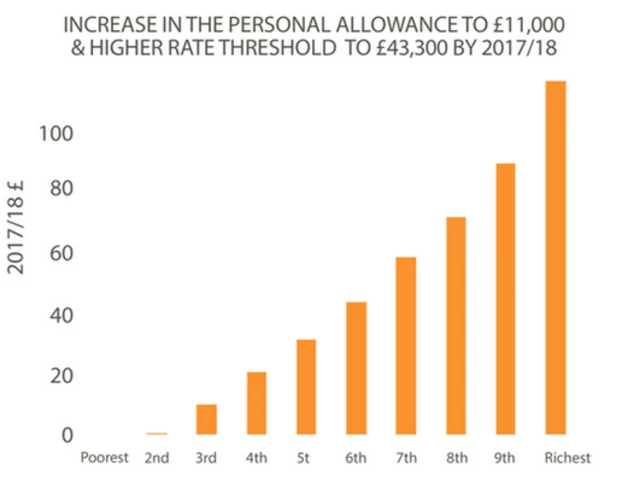

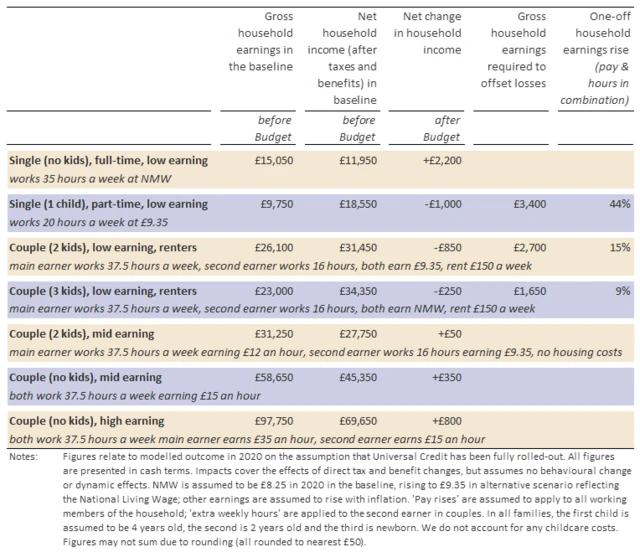

The Resolution Foundation, an apolitical think tank, has been poring over the Budget fine print - the rising minimum wage, income tax cuts and cuts to benefits - and calculated its estimates for the overall effect of the package on different sorts of families in 2020.

Here's how they explain their maths:

- "A low earning single parent with one child, working 20 hours a week at £9.35 an hour, will be £1,000 a year worse off. That is, the gain associated with the increase in the personal tax allowance is more than offset by reductions in benefit entitlement. To offset this fall in disposable income would require an increase of £3,400 in earnings – equivalent to a one off 44% rise in earnings, 18 years of steady 2% pay rises, or increasing their hours by 7 hours a week."

- "A low earning dual-earner couple with two children both earning £9.35 an hour will be £850 a year worse off. They would need a one-off rise in earnings of 15 per cent to recover these losses, equivalent to 7 years of steady 2% pay rises or a 5 hour increase in the second earner’s weekly working time."

- "A middle earning dual-earner couple without children where both earn £15 an hour will be £350 better off as a result of increases in personal tax allowance."

For a bit more detail:

Image source, Resolution Foundation

Image source, Resolution Foundation