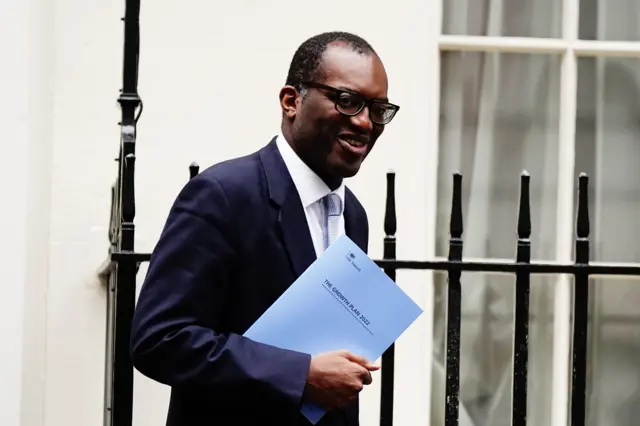

Chancellor kicks off by discussing energy billspublished at 09:38 BST 23 September 2022

Starting proceedings, Kwasi Kwarteng talks about "what's worrying British people the most" - energy bills.

"We were never going to let energy bills rise as much as they could have," he says, before praising PM Liz Truss for acting swiftly to introduce the £2,500 price cap.

Kwarteng says it's "one of the biggest interventions ever made".

"Help is coming," he says.

First words from Kwarteng as he sets out mini-budget