Little in Budget is a surprise, as May general election hopes dimpublished at 19:11 GMT 6 March 2024

Chris Mason

Chris Mason

Political editor

Image source, Getty Images

Image source, Getty ImagesThe economic and political backdrop for the chancellor today was painted in such vivid primary colours. A stagnating economy, combined with the Tory's being a million miles behind in the opinion polls. Changing the composition of either of these realities in one go would be nigh on impossible.

Little in today's Budget comes as a surprise. Almost all of it was trialled in advance. The drop in National Insurance — particularly when combined with the same cut announced a few months back — is a substantial tax cut.

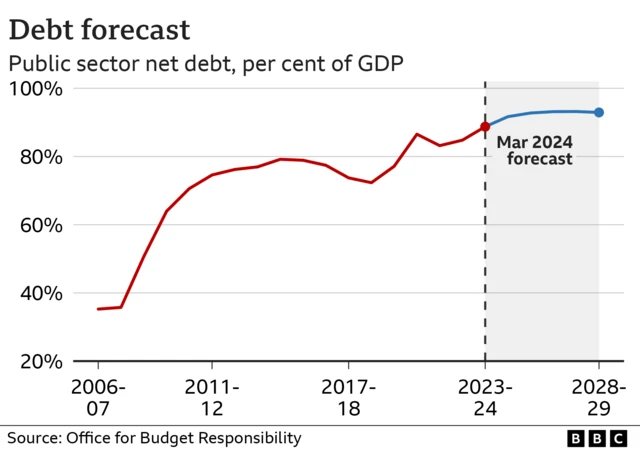

But the ballooning tax take means the rhetoric of tax cutting confronts the reality of other taxes climbing for lots of folks. This, alongside inflation, mortgage rates and the tax devoted to servicing the national debt now leaves a powerful lingering feeling for many that they are still paying more while getting less.

That will be the sentiment that Labour is seeking to seize upon.

The Conservatives will argue today's Budget amounts to the steady rebuilding of the economy after the shocks of recent years. And while there's been much speculation in recent weeks, this was not a Budget that felt like the curtain raiser for a general election in May.