How much will a further 2p National Insurance cut save me?published at 10:09 GMT 6 March 2024

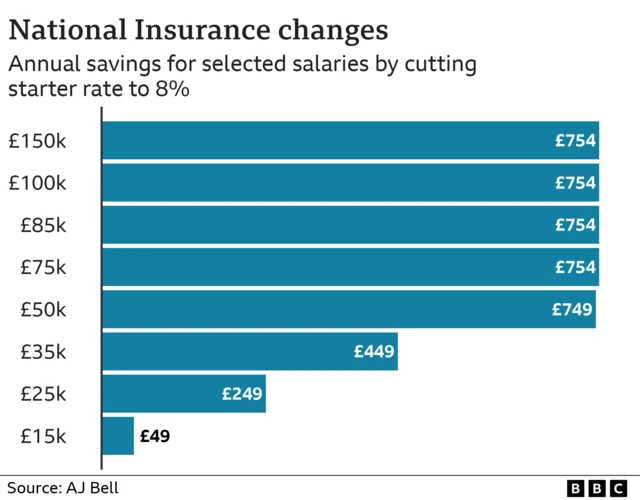

If, as widely expected, Chancellor Jeremy Hunt cuts employees' National Insurance from 10% to 8%, it will benefit the UK's 27 million workers.

The chancellor has already cut NI once, which kicked in from 6 January. A further 2p cut could begin in April.

This chart shows the expected annual savings - but remember that, if income tax thresholds are frozen until 2028-29 as planned, more people will pay higher rates of income tax, even as NI falls.