Scottish budget: The headlinespublished at 18:00 GMT 15 December 2022

Here's a recap of the major announcements in the Scottish budget:

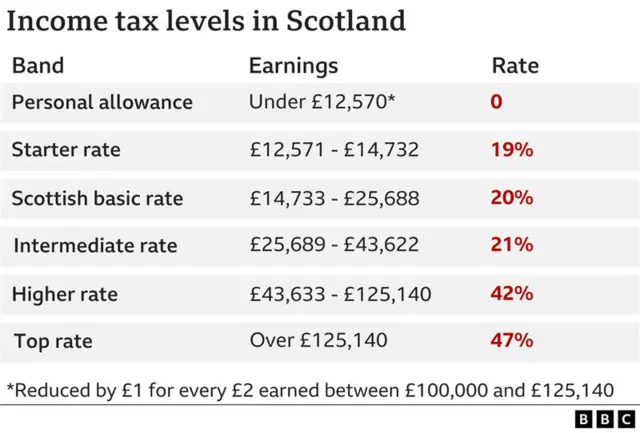

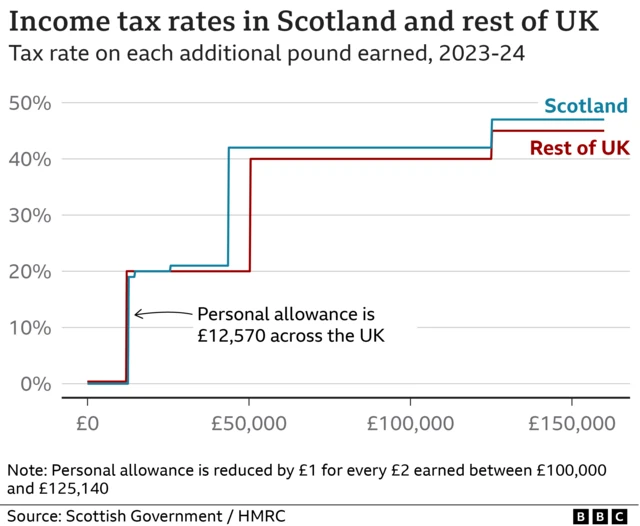

- Everyone earning more than £43,662 in Scotland will have to pay more income tax next year, an extra penny in the pound - taking it to 42p

- Deputy First Minister John Swinney said the top ate of tax will increase from 46p to 47p

- The tax threshold for the top rate will also be lowered from £150,000 to £125,140

- The threshold for the 41p higher rate will remain frozen at £43,663 in Scotland - lower than the £50,271 elsewhere in the UK

- there will be no changes to the rates paid by lower earners

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

- The changes will raise a total of £553m when taken alongside changes to other taxes including Land and Buildings Transaction Tax (LBTT)

- Councils will have the freedom to raise council tax if they wish

- The deputy first minister also confirmed an extra £550m for local government

- The Scottish Child Payment will remain at the increased level of £25 per child per week, with all other social security benefits under the control of the Scottish government being increased by the rate of inflation in September of 10.1%

- Spending on health and social care in Scotland will increase by £1bn

- funding of £20m that had been set aside for indyref2 on Scottish independence will instead be used to help people at risk of fuel poverty

That brings our live coverage to a close, thank you for being with us today.