Tax changes will widen divergence between Scotland and the rest of the UKpublished at 12:39 GMT 15 December 2022

Glenn Campbell

Glenn Campbell

BBC Scotland Political Editor

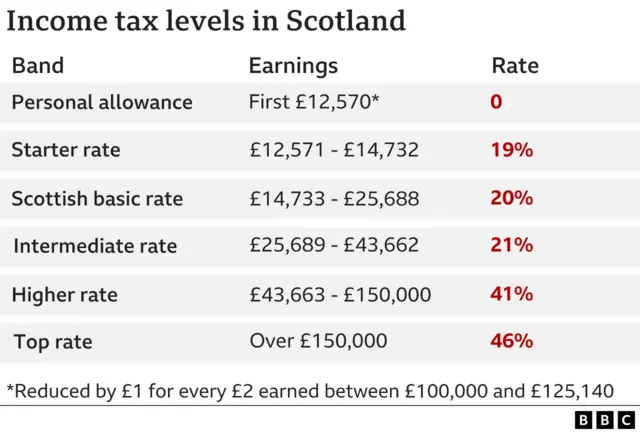

Increasing income tax rates for higher earners will be a significant departure from the SNP’s manifesto aim not to alter rates for the duration of this parliament.

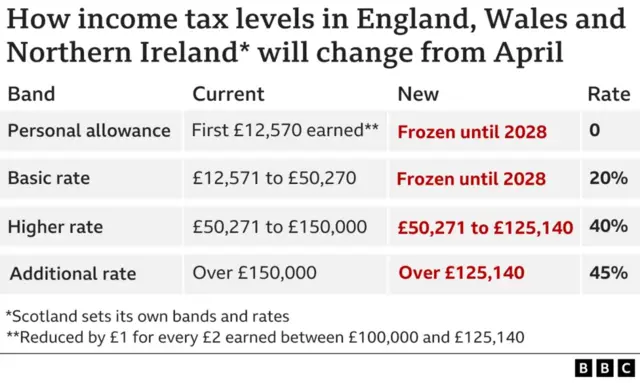

The tax threshold for the top rate is also expected to be lowered from £150,000 to something closer to £125,000 - as has already been announced for other parts of the UK by the chancellor.

These changes, overall, are designed to increase the revenue the Scottish government generates to spend on key public services.

Unions and anti-poverty campaigners have demanded tax increases for higher earners, while the Conservatives and some business voices have warned that tax rises could be a drag on economic recovery.

These tax changes will also widen the divergence in tax policy between Scotland and the rest of the UK.