Background: Scottish rate of income taxpublished at 15:09 GMT 24 February 2016

Earlier this month, MSPs voted to set a Scottish rate of income tax for the first time, opting to keep rates at current levels.

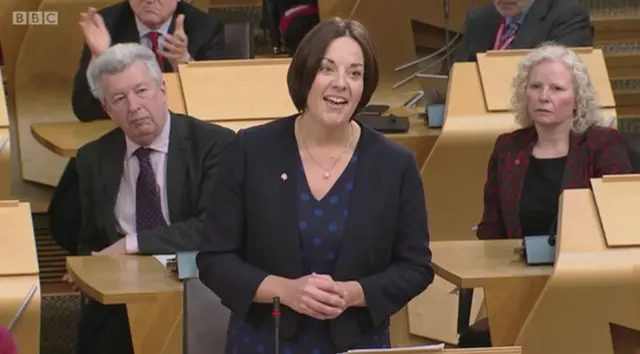

Holyrood has been given new powers over the income tax rate, with Labour and the Liberal Democrats calling for a 1p increase to raise extra funds.

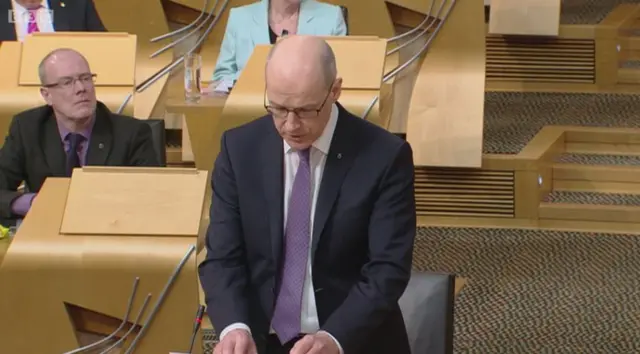

However, Finance Secretary John Swinney insisted the rate should stay the same.

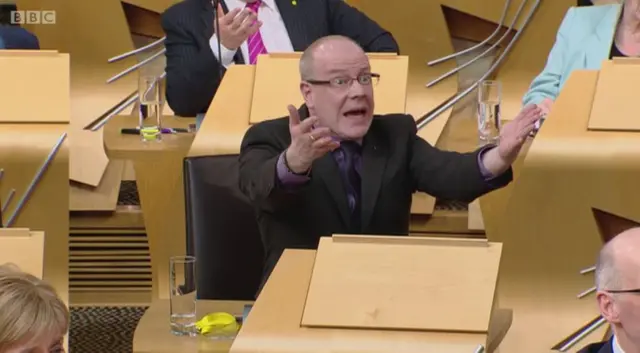

After a heated Holyrood debate on the topic, MSPs voted by 74 to 35 to accept the government's plan to maintain the income tax at current levels.

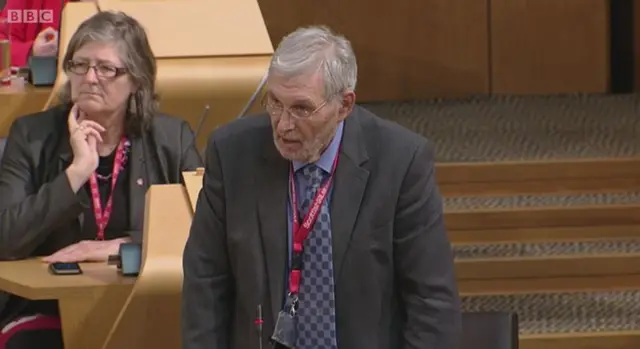

Opposition parties said an increase could create funds to protect services, but Mr Swinney said it would punish taxpayers on low incomes.