That's all from Holyrood Livepublished at 18:10 GMT 16 January 2017

Image source, Scottish Parliament

Image source, Scottish ParliamentThat's all from Holyrood Live on 16 January 2016.

We're back tomorrow morning with the Justice Comittee, from 10am.

The Commission for Parliamentary Reform hear from former first ministers Jack McConnell and Henry McLeish.

MSPs take evidence from Finance Secretary Derek Mackay on the expenditure proposals in his draft budget.

Craig Hutchison and Colin Bell

Image source, Scottish Parliament

Image source, Scottish ParliamentThat's all from Holyrood Live on 16 January 2016.

We're back tomorrow morning with the Justice Comittee, from 10am.

Finance Secretary Derek Mackay says no they don't.

A succinct end to tonight's session.

Image source, Cintra/Twitter

Image source, Cintra/TwitterThe Finance Secretary will now answer a question on Childcare Vouchers.

Mr Mackay says the government are working hard on this and have rolled out project bank accounts.

The finance secretary says the government are targeting is a 99.8% success rate.

He says the government performance in the past is a strong one.

Bill Alexander from Glasgow asks:When will he ensure that the 2009 promise on 30 day supply chain payment on government contracts happens

Image source, bbc

Image source, bbcFinance Secretary Derek Mackay

Mr Mackay says he is not sure if Murdo Fraser agrees with revaluation.

The finance secretary says the government is not proposing revaluation as it would be an expensive burden.

He says the government believe their package is fair and balanced.

Image source, PA

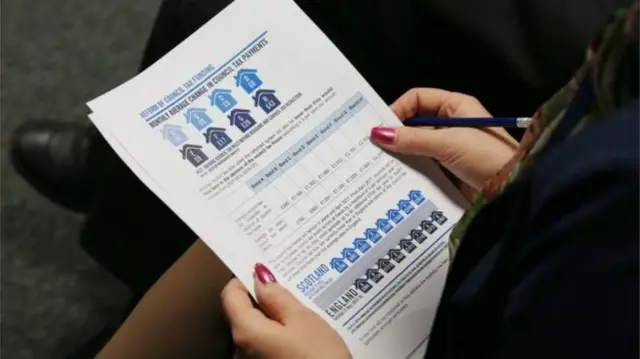

Image source, PAThe government proposals will see council tax rise for properties in bands E, F, G and H

MSPs voted to increase the top four bands of council tax - despite the final motion approving the order including criticism of the government.

The changes will see council tax bands E-H rise from April 2017.

An opposition amendment meant SNP members were forced to vote for a motion noting that they had failed to make radical enough changes.

Finance Secretary Derek Mackay said the changes were "the first step in a journey of reform".

The council tax freeze is to end in 2017, meaning all properties could potentially see their bill rise. But the order passed at Holyrood means the top four bands will rise in proportion to the others.

The average band E household will pay £2 per week more than at present, and those in the highest band about £10 a week more

A respondent from Fife (who e-mailed the Committee) asks:With regard to your proposals to accelerate Council Tax increases for Bands E and above, my research shows that modern and more energy efficient houses almost without exception tend to be placed a band or two higher than traditional, stone built, properties which has resulted in many large Victorian buildings owned by wealthy people only attracting B and D Council Tax, despite being worth as much as 40% more than a smaller new build. Therefore, as there is a likelihood that tens of millions of pounds of Council Tax revenues are being lost due to this anomaly, which is putting pressure both on councils and the Scottish Government’s finances, would it not be beneficial for all properties to be revalued during the course of 2017?

Image source, Thinkstock

Image source, ThinkstockMr Mackay says he does not have a detailed figure and it is up to HMRC to pursue tax evasion.

The finance secretary says, where the government already have tax powers, they have strong measures in place to tackle tax avoidance.

Image source, Deborah / Twitter

Image source, Deborah / TwitterThe Finance Secretary will now answer questions on Tax Avoidance.

Bernard from Musselburgh who is a PCS Trade Union representative and a Community Councillor asks:

Image source, Bernard Harkins / Twitter

Image source, Bernard Harkins / TwitterMr Mackay says there are a number of welfare interventions the Scottish government will make.

The minister say by freezing the basic rate that helps those paying that.

He says the government has specific policy around low pay.

Mr Mackay says it is a decision for UK government and there is a great deal of opposition to closures.

The finance secretary says he has been informed that staff moves will not impact on the collection of Scottish income tax.

He says the government are focused on staff avoidance and he expects HMRC to do the same.

Mr Mackay says how HMRC deploy their resources is up to them.

Administering the new Scottish rate of income tax (SRIT) will present "significant challenges", a watchdog has warned.

In its report,, external the National Audit Office (NAO) confirmed the HMRC failed to contact 420,000 people to confirm the accuracy of its records.

HMRC began contacting potential Scottish taxpayers last December.

But an error in the "design of HMRC's taxpayer identification exercise" meant 420,000 people did not receive letters.

Image source, Thinkstock

Image source, ThinkstockThe Scottish government said it had made it clear to HMRC that the identification of Scottish taxpayers "must be robust and accurate".

The letters from HMRC were intended to confirm the accuracy of its records of taxpayers who live in Scotland and would pay the Scottish rate.

After the mistake was discovered, those who had not been contacted received "coding notices" which informed them of the change in their annual tax code, and provided basic information on what is meant by an "S" code.

Image source, John Davidson / Twitter

Image source, John Davidson / Twitter Image source, John Davidson / Twitter

Image source, John Davidson / TwitterThe Finance Secretary will now answer questions on HMRC Office Closures.

Finance Secretary Derek Mackay says he does not think the convener wants him to be Twitter concise, to much tittering suggesting some MSPs want just that.

Mr Mackay says the new tax powers are being used in a fair and balanced way.

Image source, Jonathan Smith / Twitter

Image source, Jonathan Smith / Twitter