Voting for the Scottish Rate Resolution will be a lost opportunitypublished at 16:57 GMT 21 February 2017

Image source, bbc

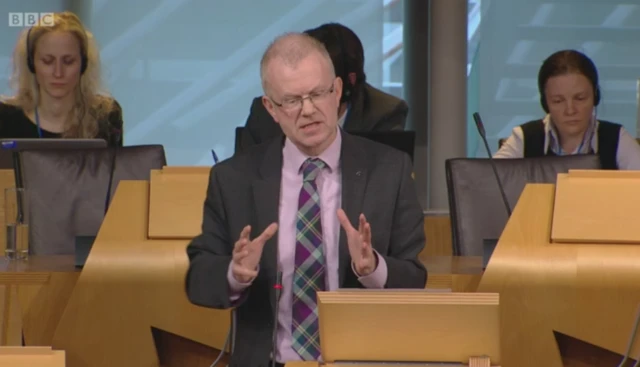

Image source, bbcLabour MSP James Kelly

Labour MSP James Kelly says this is a significant day for the parliament.

Mr Kelly says the consequences of backing the Scottish Rate Resolution will mean £170m of cuts to local councils.

The Labour MSP says if parliament votes to pass the resolution at 5.15pm then it will be a lost opportunity to address the issues facing communities.