Background: Medical research concern over Brexitpublished at 14:49 GMT 7 November 2018

Image source, bbc

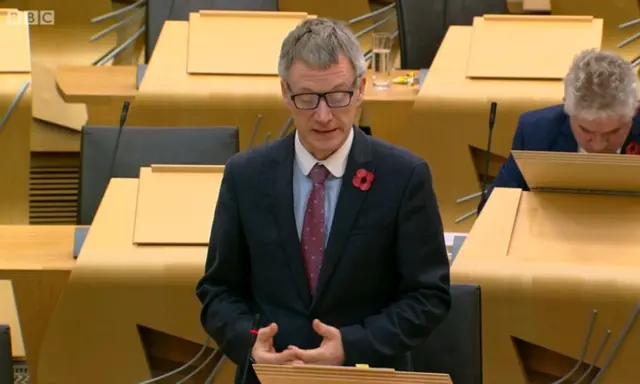

Image source, bbcDame Anna Dominiczak is the head of Glasgow University medical school

Scotland is at risk of losing its capacity to lead and shape major medical research projects after Brexit, a senior academic has said.

Prof Dame Anna Dominiczak, head of Glasgow University medical school, said Scotland's world-class reputation could suffer with pioneering science lost.

The UK government said it was looking at measures to support research in the short-term.

It said it would be developing a new international strategy.

Image source, bbc

Image source, bbc