Empty homes are 'wasted resource' - ministerpublished at 13:41 BST 26 June 2019

Image source, bbc

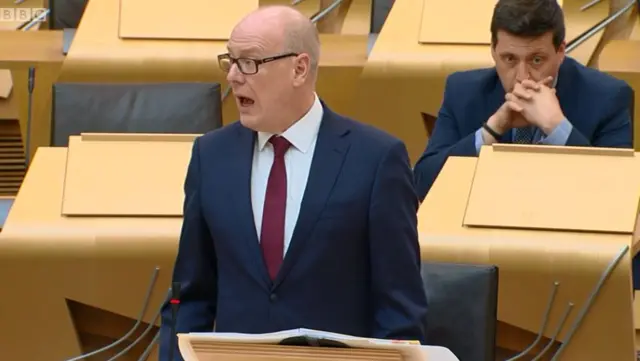

Image source, bbcHousing Minister Kevin Stewart

Housing Minister Kevin Stewart says empty homes are a wasted resource and points to funding through the empty home partnership which helps bring them back into use.

Ms Johnstone says at the current rate we would be waiting 173 years for all empty homes to come back into use.

The minister says local authorities who have invested in empty homes officers are doing much better work and he calls for more the be recruited.