Background: Scots firms call for 'more modern' business rates systempublished at 10:44 BST 26 June 2019

Image source, Getty Images

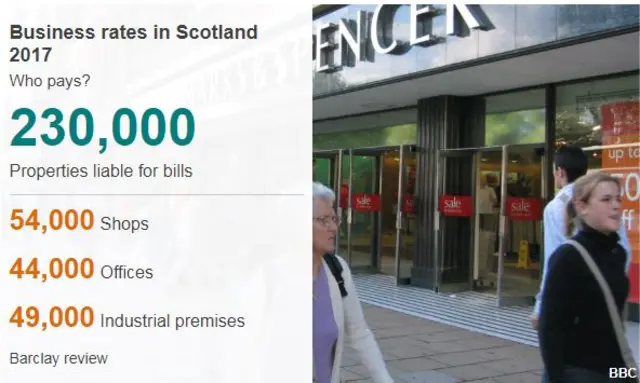

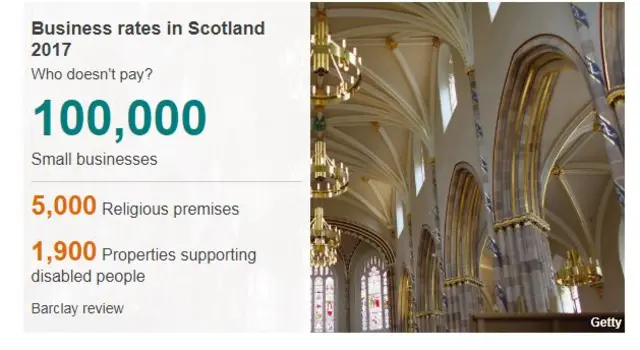

Image source, Getty ImagesPlans by the Scottish government to introduce more frequent business rate revaluations will fail unless a "more modern" tax system is delivered, according to FSB Scotland..

It said modernisation should include a new "digital rates interface".

FSB argued the move would help firms pay bills, apply for reliefs, lodge appeals and submit data.

It was responding to a consultation on proposed business rates legislation that led to this bill.