Backround: What is a credit union?published at 14:42 BST 17 September 2019

According to 'People, not profit, external' the first credit union in Britain began trading in 1964, and over the last 50 years, credit unions have grown to provide loans and savings to more than 1.2 million people across England, Scotland and Wales.

Credit unions have a proven track record across the world. In fact, 217 million people are credit union members in 105 different countries.

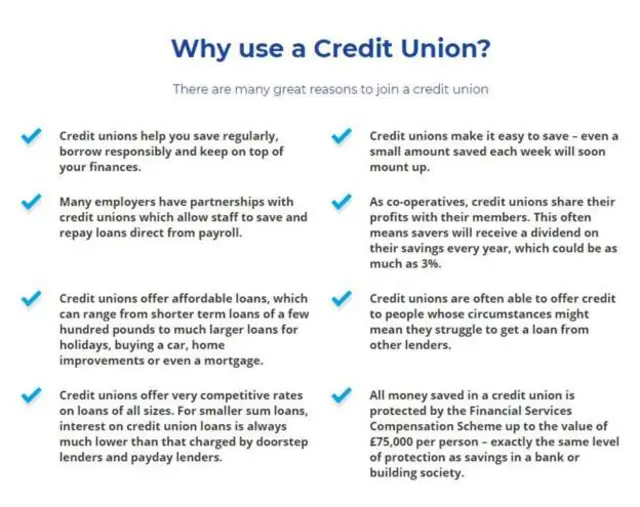

A credit union is a financial co-operative which provides savings, loans and a range of services to its members. It is owned and controlled by the members.

Each member has one vote and volunteer directors are elected from the membership, by the membership.

Credit unions are owned by the people who use their services, and not by external shareholders or investors. So the emphasis is always on providing the best service to members – not maximising profits.

Membership of a credit union is based on a common bond. This can be working for a particular employer or in a particular industry, or simply living or working in a specified geographical area which could be as small as a village or as large as several local authority areas.

Credit unions come in all shapes and sizes. Whether you’re looking for a credit union with online and phone banking, a payroll partnership with your employer, a local branch or service point you can walk into – or a combination of all three – there’s a good chance you’ll find the credit union you’re looking for to meet your needs.