Greens call for council tax reformpublished at 15:32 GMT 4 March 2020

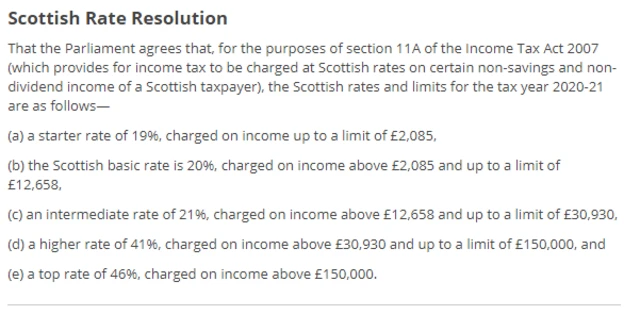

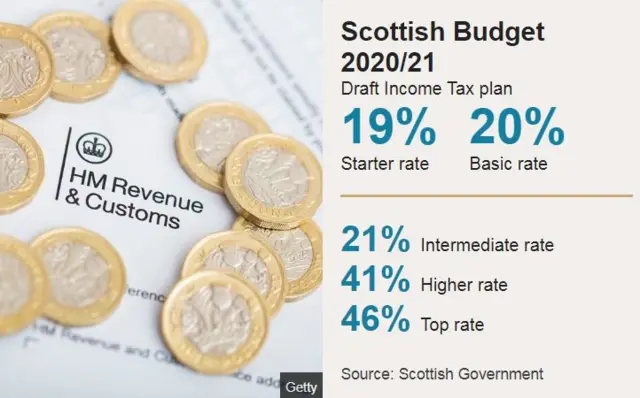

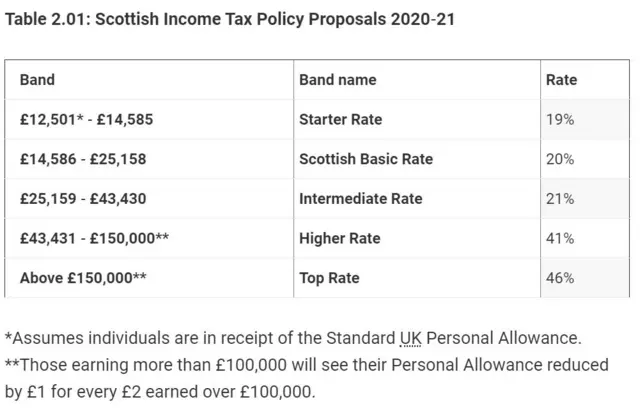

Mr Harvie says a combination of income tax changes and council tax changes mean high income households tend to be paying more, while low income households are protected.

But I do not think this is enough to tackle poverty he states.

If we want to achieve more we need to look at other mechanisms he argues, calling for council tax reform.