Greece in crisis: How European debt problems affect you

- Published

Talks to form a new Greek government are getting back underway after ending on Monday night without a deal.

Politicians there are struggling to agree on how to handle their growing financial crisis, a situation which could hit the economy in the UK.

Three attempts to form a government have failed. If the parties can't agree on a coalition, new elections will have to take place next month.

Voters in Greece's elections turned away from parties supporting severe cuts in the country.

They oppose austerity measures needed to meet the terms of the 130bn euro (£105bn) bailout agreed with the EU and International Monetary Fund (IMF).

But why might the problems in the 'eurozone' make any difference to you?

What is the eurozone?

This is the name given to 17 European countries which use the euro, including France, Germany, Spain and Ireland.

What is the problem?

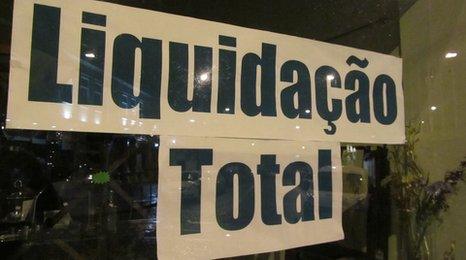

Several countries in the eurozone have borrowed and spent too much since the global recession, losing control of their finances.

Greece was the first to take a multi-billion pound bailout from other European countries in May 2010, followed by Portugal and Ireland.

Their governments had to agree to spending cuts before the loans were approved.

But now, with the parties in Greece who voted for the plan unable to form a government, there are concerns that the rescue plan could fail and the country could leave the euro, sparking instability in Europe.

What's going on in Greece?

Many Greek people don't want any more tax rises and public sector job losses, but tough spending plans have been pushed through so the government can receive billions in bailout money.

There were protests in Athens last year with some of them violent

There have been protests on the streets and strikes at power stations.

This has led to some people being left without any electricity.

Greece's parliament approved extra tax rises and spending cuts in December.

Recent parliamentary elections have thrown Greece into political uncertainty, with former coalition parties New Democracy and Pasok unable to get enough votes.

The left-wing Syriza party - which wants to reject the austerity measures imposed on it - did not attend the latest talks.

But experts think that may also fail and Greece will have to hold fresh elections.

Another result of the election is that the far-right Golden Dawn party, which wants an end to immigration to the country, has gained 21 seats in parliament.

The party has been described as by some as a 'neo-Nazi' organisation.

What is the fear?

If Greece is unable or unwilling to keep paying what it owes to the rest of Europe, the country will effectively go bankrupt.

This would make life even tougher for Greek people, who would feel much poorer as their money wouldn't be worth as much.

Governments in other Eurozone countries like Ireland and Portugal would have to pay more to borrow money and might have to raise taxes and cut spending to balance the books.

Where does the UK come into this?

As the UK is not in the euro, it hasn't contributed to Greece's bailout, except through its membership of the IMF, which lends to countries around the world.

But some British banks have lent money to Greece and would lose billions if the country went bankrupt.

They would lose even more if the problems spread to other countries like Spain and Italy.

If the banks are hit hard there could be another credit crunch, making it much harder for British people and businesses to borrow cash for loans and mortgages.

Companies in the UK also do many of their trade deals with firms in Europe, so financial problems overseas would affect British business too.

- Published7 December 2011

- Published6 June 2012

- Published17 November 2010

- Published17 November 2010