UK lenders to offer Zapp payments in banking apps

- Published

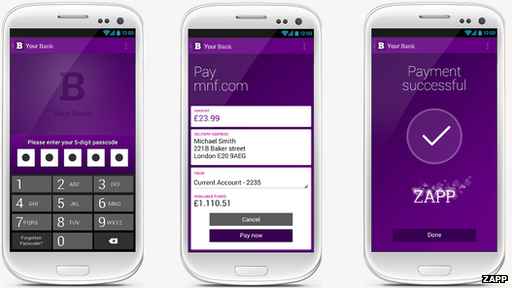

Zapp's payments service will be added to existing banking apps

Five UK lenders are to add a mobile payment facility called Zapp to their smartphone and tablet apps.

It will allow their customers to pay for goods or services in shops or online without the need for cash or a credit card.

The firm behind the tech - Vocalink - suggests it is more secure than alternatives since a user's bank details are not shared.

But other mobile wallet products have had mixed fortunes in the UK.

Telefonica announced last week that it was shutting down its O2 Wallet service just 18 months after it launched. The firm had required members to transfer funds into its app before using it.

The firm said it now wanted to find "better ways" to make mobile payments.

Barclays Bank continues to offer Pingit - an app that allows users to link their bank accounts to their mobile numbers in order to transfer funds to each other and a selection of retailers.

PayPal also offers an app that allows consumers to make and receive digital payments, but requires them to provide it with their bank or credit card details. Orange's Quick Tap and Moneto are other examples of phone-based payment systems.

One analyst suggested that the fact Zapp would be integrated into existing banking apps - meaning users would only need to accept the relevant terms and conditions to start using it - should give the service an advantage.

"We carried out a survey of 15,000 consumers across 15 markets including the UK and one of the questions we asked was, 'Who would you trust most to handle mobile payments?'" said Eden Zoller from the telecoms consultancy Ovum.

Retailers who do not have NFC or QR code equipment can give the user a six-digit code to activate the payment

"Most said banks and financial companies. So, it's pretty smart for a payment service provider to align itself very closely to these organisation and integrate itself into their existing apps."

Digital receipts

HSBC, First Direct, Nationwide, Santander and Metro Bank are the first lenders to announce they will adopt Zapp ahead of its launch, which is planned for the autumn.

Consumers will be able to use it in a variety of ways:

If making a purchase online via smart device, selecting Zapp at checkout will launch their banking app which will then contain details of the transaction

If shopping via a PC, clicking on Zapp's icon will send a notification to their smart device, which, when selected, will launch the banking app and give it the necessary data

Bills received by post can be paid by using the smart device's camera to scan a QR barcode printed in the paperwork that will provide details of the charge to the app

If shopping in a store the app will either receive a payment request by tapping the phone on an NFC (near field communication) terminal, by scanning a QR code from a screen or by typing in a six-digit code provided by the till operator

In each case, to complete the payment the smart device owner will need only to tap a button in the banking app.

Barclays is promoting its own money transfer service

"We will be the only payment method where at the point of sale the customer can see the real-time balance of their accounts," Zapp's chief executive Peter Keenan told the BBC.

"This allows them to say, 'I've got this much money in my account, shall I go ahead and buy this product or not?'

"And because they are using a smartphone, it allows them to keep a record of all their spending and purchases in one device."

He added that the firm's range of partners should reassure retailers weighing up the cost of installing the necessary equipment.

In addition to the banks, Vocalink has also struck deals with several leading payment processors used by British stores. These firms will pay Vocalink a fee each time Zapp is used.

But Ms Zoller said the company needed to convince other banks and the wider public of the service's merits if it was to fulfil its potential.

"Digital wallets can be quite a difficult proposition for consumers to get their head around," she said.

"What we've seen in other cases is that consumers may look at and even try them, but they have not been convinced they provide real additional value or convenience beyond contactless cards or even cash."

- Published13 March 2013

- Published26 April 2012

- Published5 September 2012