Steel crisis: UK government plays down China tariff fears

- Published

The government has played down the impact on the UK steel industry of new Chinese import tariffs of up to 46.3%.

China is to impose the levy on imports of some specialist, high-tech steel from the EU, South Korea, and Japan.

It comes after Tata Steel announced it was selling its loss-making UK plants, putting thousands of jobs at risk.

The duties were "unwelcome", but "not expected to have much impact", the government said - but Tata said it was worried about the wider market effect.

The company - and UK government - has previously cited cheap steel imports from China as one of the reasons the industry is under pressure.

What's going wrong with Britain's steel industry?

The Chinese ministry of commerce said imports of grain-oriented flat-rolled electrical steel - a type of high-tech steel made by Tata's Cogent subsidiary in Newport - would be charged duties ranging from 14.5% to 46.3%.

The US has imposed tariffs of 266% on Chinese steel but Britain blocked efforts at EU level to impose similarly high emergency tariffs.

'Drastic measures'

A government spokesman said the UK had been at the forefront of pressing for European action on unfair steel "dumping" - selling steel very cheaply and regularly at a loss - but it was important for tariffs to be set at the right level, based on clear evidence of unfair trade.

"It is in no-one's interests for there to be an escalation of protectionist tariffs," he added.

Gareth Stace, director of industry body UK Steel, said the direct impact of the new Chinese tariffs was small - but the move represented a "tit for tat trade war that may escalate further".

He said the UK and other EU governments must use "drastic measures" to tackle the "flood" of Chinese imports into Europe.

Tariffs currently imposed in the EU were too low and took too long to come into effect after being agreed, he said.

Analysis

BBC business correspondent Joe Lynam

This is a warning shot across the bows from the Chinese to the Europeans.

There has been a lot of talk within the EU about slapping huge tariffs on Chinese imported products, and the impact that would have.

The Americans have already done so with tariffs of 266% on Chinese imported steel.

While this particular tariff is going to have virtually no impact on European steel - simply because it is so specialised - this could be viewed as the Chinese getting their revenge in before they're even attacked.

The message is: "We can start at small products, but we can build up to really hurt your goods if you really want to go down this road."

The big picture of course is that China has been accused of "dumping" - selling their steel for below what they sell it for in their home market - and that has destroyed British steel.

The political pressure on the UK government to do something to rescue British steel - a symbolic industry - is ever mounting.

Tata said the type of steel affected by the Chinese tariffs had not been exported "in recent times from our UK operations", but it was concerned about the knock on effect on other countries looking for alternative markets for their products.

It also highlighted the "ongoing disparities between the high tariffs set by other countries and the low tariffs which continue to be set by the EU".

Earlier, Downing Street said David Cameron had raised his concerns about the steel crisis with Chinese President Xi Jinping during the Nuclear Security Summit in Washington.

Mr Cameron said they needed to work together to tackle "over-capacity".

'Back foot'

Commenting on the Tata situation, he said every effort was being made to save jobs after the company's decision to sell its loss-making UK plants - but he warned there were "no guarantees of success".

Labour's deputy leader Tom Watson told the BBC the government had been "on the back foot", and should have changed procurement rules to ensure a role for British steel in big projects such as HS2.

He said Business Secretary Sajid Javid seemed "harnessed to his ideology" and unable to see a role for temporary state intervention.

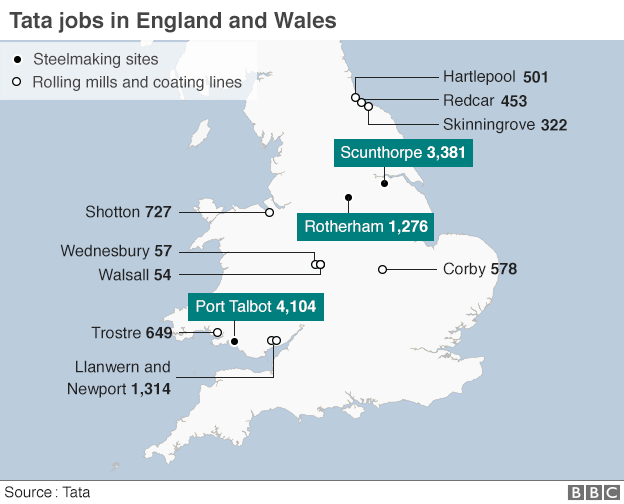

Tata's UK business - which directly employs 15,000 workers and supports thousands of others - includes plants in Port Talbot, Rotherham, Corby and Shotton.

Steel production makes up 1% of Britain's manufacturing output and 0.1% of the country's economic output.

- Published2 April 2016

- Published31 March 2016

- Published31 March 2016

- Published30 March 2016