Ulez: Drivers can reclaim charge in tax return - HMRC

- Published

Drivers will be able to claim the expense if the trip into London's Ulez was "solely for business"

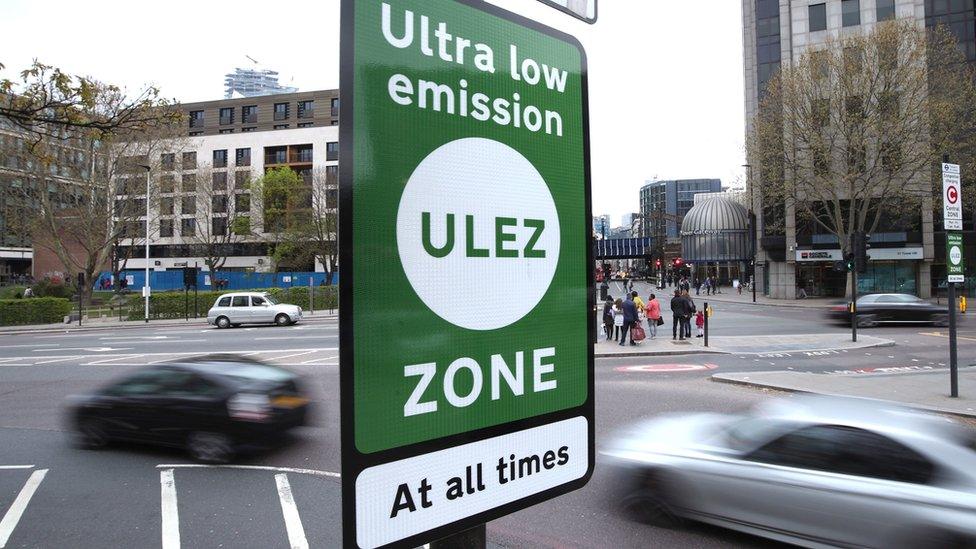

Self-employed drivers will be able to claim tax relief on the daily Ultra Low Emission Zone (Ulez) charge.

Workers with non-compliant vehicles can claim if their journey was "exclusively for the purposes of the trade".

Ulez was expanded to include all of London's boroughs on Tuesday.

"This is a shot in the arm for sole traders, whose businesses will be hit by the Ulez charge from today," said Craig Beaumont of the Federation of Small Businesses (FSB).

Those who are self-employed are able to claim tax relief on their travel expenses, including low emission zone charges, through their self assessment tax return.

This type of tax relief does not apply to commutes or non-business travel costs, external.

A spokesperson for Transport for London (TfL) said: "Rules around tax deductible expenses will apply in the usual way to Ulez charges.

"This is a matter for HMRC but it is likely to depend upon the nature of the operation and circumstances around incurring the charge as to whether it is tax deductible, as is the case for other expenses".

In a statement HMRC said: "Self Assessment customers are entitled to tax relief on travel expenses, including low emission zone charges, if they have been incurred wholly and exclusively for the purposes of the trade.

"When a self-employed individual claims an allowable expense, the amount is deducted fully from their taxable profits."

Follow BBC London on Facebook, external, Twitter , externaland Instagram, external. Send your story ideas to hellobbclondon@bbc.co.uk

Related topics

- Published29 August 2023

- Published29 August 2023