Why are fewer people buying homes in Greater Manchester?

- Published

New housing available in Manchester city centre tends to be buy-to-let and rental properties

Home ownership has fallen more sharply in Greater Manchester than anywhere else in England. Why?

The proportion of home owners dropped from 72% in April 2003 to 58% this year in Greater Manchester, according to a Resolution Foundation report.

With housing pressure indicators usually focused on London and the South East, casual observers may be surprised that so many of the region's 2.8 million people rent their homes.

Why are ownership rates across the region on a downward turn?

Is it just too expensive?

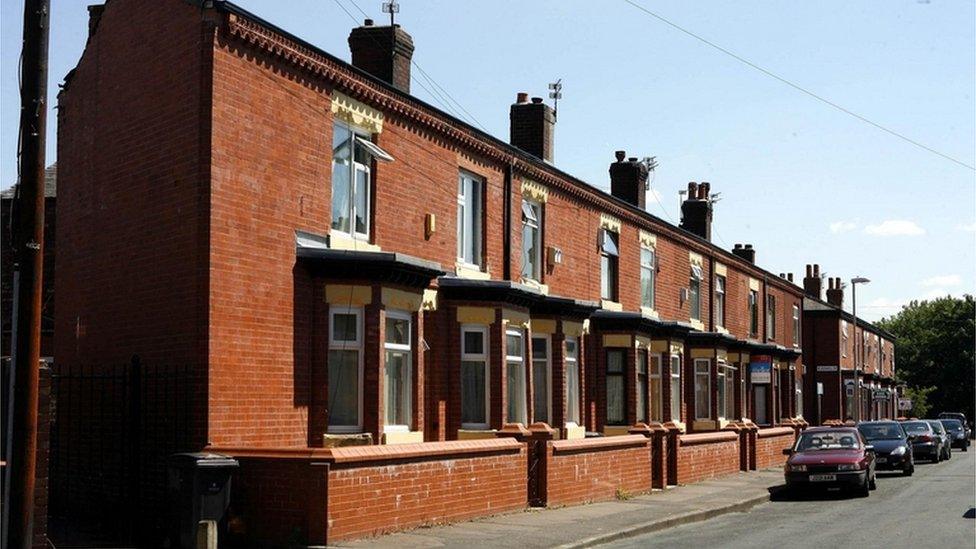

Manchester has some of the poorest districts in the country and a requirement for big deposits could be deterring people from buying

According to the property website Rightmove, most of the sales in Manchester - one of the region's 10 boroughs - over the past year were flats, which on average sold for £146,754.

Terraced properties had an average sold price of £138,946 and semi-detached properties averaged £188,096. Zoopla data showed an average price for a three-bedroom property in Greater Manchester was £165,320.

Against this, the average north west salary is £25,584. So could it be that price is the main reason people are not buying property?

Financial Analyst Louise Cooper said the problem was house cost to wage ratios. "The average house price in England in 1986 was £38,000, today it is £226,000," she said. "Over the same period the average salary has gone up two and half times.

"The price of property compared to salaries has gone up hugely. Everyone says it is a London problem. It is not. Manchester is one of the worst."

Dave Power, chief executive of housing association One Manchester, agrees the problem is simple.

"People can't get mortgages. The average salary is about £25,000. You can buy a house for £95,000 but you need a £10,000 deposit," he said.

"People are struggling with low wages and I think that is the biggest challenge."

Has society changed?

A tendency towards city living has changed the nature of the property market in Greater Manchester, according to a property expert

The 2011 Census data shows the city of Manchester moving towards smaller average household sizes, with more single people aged under 65 and a relative decline in the number of households made up of families with children.

This means the average household size is set to be lower over the next decade and, with the increase in private sector renting, more transient, it added.

Frazer Fearnhead, CEO of The House Crowd, said Manchester had a large graduate population in apartments across the city centre.

"They are mostly lived in by young professionals who choose to rent," said Mr Fearnhead.

"We are not comparing apples with apples [previous decades]. There is a lot less pressure to get married and have children and therefore there is less desire to buy family homes."

Ian Waxman, MD for estate agent PAD Residential said Manchester was a "destination city" that people want to live in.

He said young people liked to rent because it was a "quicker transaction" and it gave them "flexibility in the job market".

Are there enough homes being built?

Greater Manchester needs investment and support to build more affordable homes, according to interim mayor Tony Lloyd

During the EU referendum campaign Brexit-backer Iain Duncan Smith said the UK would need to build 240 houses a day for 20 years to cope with increased demand. That claim was substantiated by the BBC.

Mr Fearnhead believes that Greater Manchester mirrors the rest of the country in the fact there are not enough houses being built, fuelling a demand that pushes up prices.

A recent report from the Greater Manchester Combined Authority said up to 217,000 houses would be needed by 2035 to meet demand. The current rate for completion is 6,000 a year.

Greater Manchester's interim mayor Tony Lloyd said: "To reverse this trend [on home ownership] we know that we have to build more homes and ensure a better mix of housing that enables all of our residents to find a home they can afford in an area where they want to live."

He called for the government to fund affordable social renting, not just owner-occupier schemes.

Land needed to be made affordable, he said, because not all brownfield sites are feasible without investment - and funding and support is needed to develop on them.

Mr Lloyd said: "In Greater Manchester we are taking action with the powers we have but more must be done by central government to enable us to build the homes Greater Manchester needs now and in to the future."

Greater Manchester has a £300m housing scheme to loan funds to developers. This aims to fund 15,000 new homes.

Mr Fearnhead's company is a property crowd-funding platform, which has eight sites across Greater Manchester developing housing.

He believes "forward-thinking councils" encourage development, helping provide more affordable housing, but argued that some councils "discourage development".

Market forces, he added, should be left to themselves because if nobody could afford to buy a property the price would come down.

Is Greater Manchester's population growing too quickly?

2011 Census data said Manchester was moving towards smaller average household sizes and an increase in private sector renting

The latest census took place in March 2011 and estimated that Manchester was the fastest growing city outside London, having grown by 19% over the decade, reaching just over 500,000 (503,127).

Dr Andreas Schulze Baing from the School of Environment, Education and Development at the University of Manchester agreed that a large part of the population growth could be explained by growth in and around Manchester city centre.

Housing available there tends to be buy-to-let properties and renting households, which are more transient, he said.

European and global migration could also be a factor, he told the BBC. Migrants may initially prefer settling in major cities and may find if difficult to get access to a mortgage, so renting is often the only option.

Dr Schulze Baing warned that renting under short-term contract conditions was "a challenge".

"I'm originally from Germany, where renting is a viable long term tenure option for many households because of stricter regulation of the market, and protection of long-term tenants."

Is renting really a problem?

Private renting figures have tripled in Greater Manchester according to the report, but the cost of rental payments could also be a challenge.

The proportion of private tenants rose from 6% to 20% last year, it said.

Brian Robson, from Joseph Rowntree Foundation, said people were paying "extraordinarily high rent" in Greater Manchester and there was not enough social housing.

"If you're paying that rent every month, you can't save for a deposit," he said.

But renting offers an attractive option for the city's masses of graduates and young professionals attracted to the city centre and areas such as Salford Quays, according to Dave Power

"Manchester city centre had a few thousand people living there a decade ago," he said.

"That is now tens of thousands, mostly in private rented sector properties reflecting probably the younger population which has joined Manchester through digital and business jobs."

- Published2 August 2016

- Published22 April 2016