Apostle Accounting: Man wrongly told he owed HMRC £36,000

- Published

Edward Sturgeon and his wife Sally thought they would have to sell their house to repay the amount

A lorry driver caught up in a tax scandal has described his fury at HM Revenue and Customs (HMRC) after it mistakenly sent him a £36,000 bill.

Edward Sturgeon, 55, is one of hundreds of people who, according to HMRC, were wrongly paid tax rebates claimed through a Suffolk company, Apostle Accounting.

Mr Sturgeon was told he owed £3,000 and the invoice blamed on a typo.

HMRC has apologised to Mr Sturgeon.

It said the correct figure was mentioned elsewhere in the information sent to him at the time.

Mr Sturgeon, from Ipswich, received a video call from his wife Sally on 31 May to say the demand had arrived, leading to "12 hours of panic".

"She looked like a ghost. I thought somebody had died" he said, adding "I was 200 miles from home and it took me two hours to calm my wife down".

He was a former client of Apostle which is currently at the centre of a police investigation after hundreds of people were handed four and five figure bills.

They received tax refunds for work-related expenses but have since been told by HMRC their claims have been disallowed.

Apostle has always denied any wrongdoing.

Almost seven hundred people have now either received bills, or say they are expecting one, according to figures compiled by former Apostle client Lee Osborne.

He said the total amount which needs to be repaid has now passed the £3m mark.

MP's have lobbied HMRC about the situation and two weeks ago the BBC revealed the police's East Region Special Operations Unit was investigating.

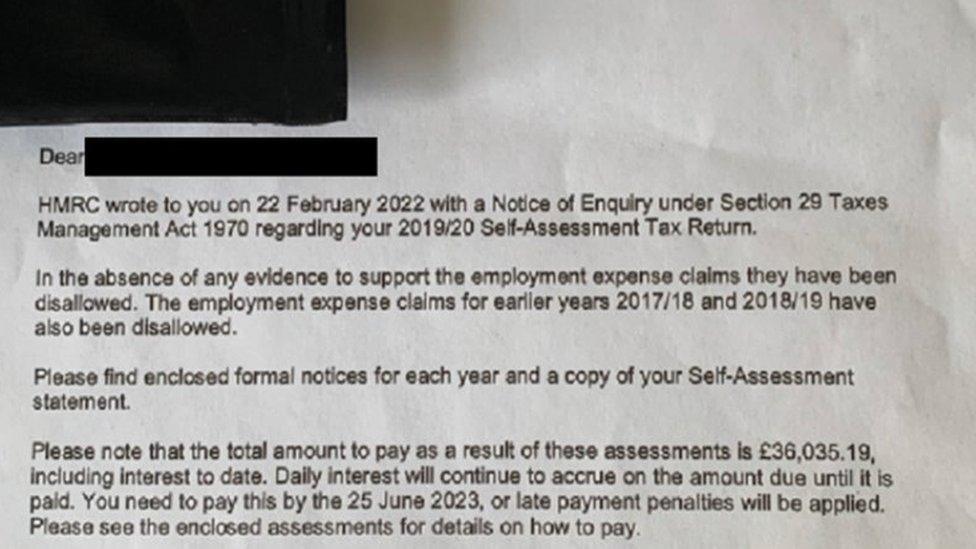

The letter from HMRC wrongly informing Mr Sturgeon he owed more than £36,000

'This has been horrendous'

Mr Sturgeon, who travels the country for his work, managed to get through to a representative from HMRC the morning after he received the call from his wife.

He said a member of staff told him there had been a typographical error on his demand letter and that he owed about £3,000 but no apology was forthcoming.

Mr Sturgeon said before the error was confirmed "we were wondering how the hell we would pay the money back".

He and his wife feared they would be made homeless because they would have to sell their house to cover the debt.

Mr Sturgeon was scathing about HMRC's conduct, pointing out the hundreds of other people who are facing large bills.

Mr Sturgeon, a former soldier, inside the cab of the lorry he drives for a living

Welfare concerns

"These are people who are supposed to be professional - if this was a private business, it wouldn't last" he added.

He said he was also concerned for the welfare of the other people in a similar position.

"This has been horrendous" Mr Sturgeon added.

Apostle Accounting denies any wrongdoing after hundreds of its former clients received large tax bills

Apostle Accounting, which is based in Stowmarket, had previously blamed HMRC for the situation.

It said HMRC had not followed its own rules and guidance and denied any allegations of "non-compliance issues and/or fraudulent tax claims".

Apostle added that HMRC had reviewed its approach to the expense claims in 2019 and found it to be acceptable.

The firm quoted independent advice it had obtained, which stated HMRC "appeared to be wrong, outside the law and its own guidance".

An HMRC spokesman said: "We'd like to apologise to Mr Sturgeon for this isolated mistake, which only affected the covering letter.

"Customers can make their own claims direct with us online at GOV.UK and if they do so, can keep all of what they are due.

"You should treat promises of easy money with real caution - if it sounds too good to be true, it probably is. Handing over sensitive personal information could leave you having to pay back the full value of any invalid claim made on your behalf."

Follow East of England news on Facebook, external, Instagram, external and Twitter, external. Got a story? Email eastofenglandnews@bbc.co.uk, external or WhatsApp us on 0800 169 1830