Apostle Accounting: MPs meet with HMRC over tax scandal

- Published

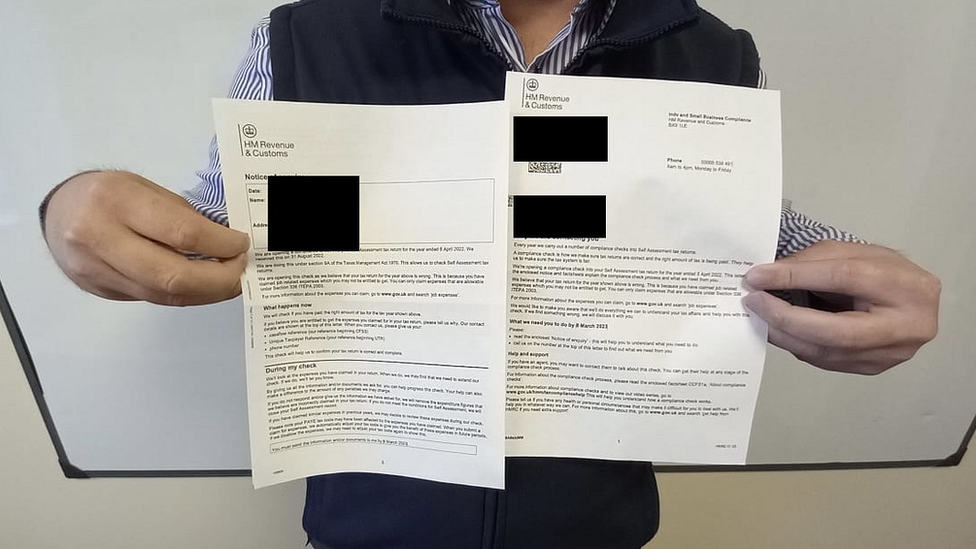

A former Apostle client, who wished to remain anonymous, holds a repayment notice from HMRC

About two dozen MPs or their representatives have met with HM Revenue and Customs (HMRC) over a tax scandal that has left hundreds of people facing large bills.

Former clients of Apostle Accounting have received the demands after being wrongly paid rebates for work expenses made through the company.

The Suffolk-based firm has denied any wrongdoing.

Organiser Jo Churchill MP said "it was a good first meeting".

Suffolk Police said it was investigating after receiving complaints and referrals from almost 200 people.

Ms Churchill, the Bury St Edmunds Conservative MP, said HMRC had agreed to look at ways to help people who had received large tax bills, some of which were for tens of thousands of pounds.

She added if anyone else had been affected they should get in touch with their local MP, but declined to comment further.

BBC East political correspondent Andrew Sinclair said several MPs privately described the meeting as "frustrating", saying that while there was a police investigation under way there was little they could do.

He added that they also believed all those who had tax bills would ultimately be expected to pay them in full.

The meeting was held in a committee room at the House of Commons and attended by HMRC's director of individuals and small business compliance, Marc Gill.

Apostle Accounting, which is based in Stowmarket, offered a service that submitted tax rebate claims based on work expenses to HMRC.

The exact number of people affected is unknown, but Apostle said 1,400 clients had used the service between 2016 and 2021.

'Devastated'

According to figures compiled by a former client, Lee Osborne, at least 550 people have stated they owed or had already paid HMRC money totalling more than £2.5m so far.

Another former client, Ian Goadsby, a UPS driver from Coventry, received a demand for £6,500 the day before the meeting.

He said: "I feel absolutely disgusted and devastated. It says I have got to pay it back by June 3rd.

"I simply do not have that kind of money to put my hands on," he added.

Jo Churchill MP organised the meeting with HMRC in a committee room at the House of Commons

Previously, Apostle Accounting blamed HMRC for what had happened.

It denied any allegations of "non-compliance issues and/or fraudulent tax claims" and that HMRC had reviewed Apostle's approach to the expense claims in 2019 and found it to be acceptable.

The firm quoted independent advice it had obtained, which stated HMRC "appeared to be wrong, outside the law and its own guidance".

A HMRC spokesman said: "We have had a constructive meeting with a number of MPs with constituents who have raised concerns about their dealings with a repayment agent."We will continue to work with those MPs on this matter, and will do everything we can to support taxpayers who engage with us to get their tax affairs in order, including offering payment plans to settle tax debts."

Find BBC News: East of England on Facebook, external, Instagram, external and Twitter, external. If you have a story suggestion email eastofenglandnews@bbc.co.uk

Related topics

- Published28 April 2023

- Published27 April 2023

- Published26 April 2023

- Published19 April 2023