NI shale gas deposits 'could be worth £80bn' says report

- Published

Julian Fowler reports for BBC Newsline

Shale gas deposits in Northern Ireland could be worth about £80bn according to a new report by consulting firm PwC, external.

It is believed most of the reserves are in the north west and Fermanagh.

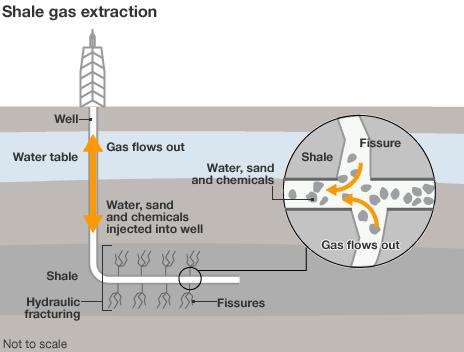

The gas would need to be extracted using a controversial process known as hydraulic fracturing, or fracking.

Sinn Féin have claimed the report was "one-sided" and "sensationalist". The issue of fracking has divided the community in Fermanagh in recent years.

In order to carry out fracking a company must receive a licence from the Northern Ireland executive.

Fracking involves drilling horizontally into the rock, forcing sand and water underground to cause tiny fractures that release gas from the shale.

However it is a controversial process. In November 2011 another company, Cuadrilla, admitted that its drilling for gas was the "likely cause" of minor earthquakes in Lancashire.

And in the US, where the process is most advanced, there have been cases of water pollution linked to fracking.

'Lower prices'

PwC have said that exploiting shale oil in the UK could boost GDP by up to £50bn by 2035 as well as the world economy.

In Northern Ireland, the gas reserves have been estimated to be the equivalent of about 1.5bn barrels of oil.

John Hawksworth, chief economist at PwC and co-author of the report, said: "Lower global oil prices due to increased shale oil supply could have a major impact on the future evolution of the world economy by allowing more output to be produced at the same cost.

"These effects could build up gradually as shale oil production rolls out across the world to produce an estimated rise in global GDP of around 2.3%-3.7% in 2035.

Shale oil is extracted using a controversial process known as fracking

"Without shale oil, it is likely that global oil prices would continue to rise in real terms over the next few decades due to the pressure of rising demand from China, India and other emerging economies.

"Experience over the past decade suggests that UK governments find it very difficult to raise motor fuel duties in these circumstances."

But Sinn Féin's energy spokesman Phil Flanagan accused PwC of promoting an agenda on behalf of multinational energy companies interested in making big profits.

"It is clearly in the interest of energy companies to over estimate reserves and this is consistently a tactic they use to achieve government and public support," he said.

"What we actually need to see is a significant investment in renewable heat generation from governments and not some foolish effort to chase the last remaining stores of fossil fuels around the world, using non-conventional and dangerous methods of exploration."

'Alternative fuels'

Michael Young, director of the Geological Survey Northern Ireland said: "The development of natural resources is always exciting and that is why we geologists engage in it.

"I would also say in this case it is a very important development . The whole business of energy exploration and supply is important," he said.

Fracking has been blamed for the pollution of water supplies and causing earth tremors

Donal O'Cobhthaigh from Ban Fracking Fermanagh said exploiting the reserves would result in a significant industrialisation of the county.

"We would be very concerned about the economic cost in terms of the jobs that would be lost in tourism, in agriculture and also the health concerns of the local community," he said.

"Agriculture is the number one sector in Fermanagh, tourism is the number two sector.

"These are two sectors we don't want to see destroyed unnecessarily.

"Even if you look at the wider long term consequences, what is this about? It's about developing oil and gas at the very time the whole world needs to be moving towards alternative fuels such as green energy."

- Published14 February 2013

- Published2 November 2011

- Published28 January 2013

- Published28 June 2012

- Published21 June 2012

- Published14 June 2012

- Published4 February 2012

- Published1 February 2012

- Published6 December 2011

- Published24 January 2013

- Published10 October 2012

- Published1 October 2011

- Published25 July 2012

- Published12 June 2012